France

VC firms back €65m financing for BioSerenity

Fresh capital will be used to develop BioSerenity's products beyond their initial focus

Eurazeo, BPI France et al. invest €70m in PayFit

Previous round for France-based fintech startup PayFit was a €14m series-B in 2017

Qualium and BPI France to invest in EM Lyon

Qualium is currently investing via its second fund, Qualium II, which aims to make majority buyouts

Andera exits Europ Net in management buy-back

Management buys cleaning services provider Europ Net, five years after spinout from Samsic

Partech et al. invest $22.7m in Lifen

In 2018, Daphni and Serena invested €7.5m in Lifen, a healthcare messaging platform

Capgemini and Isai launch €90m Isai Cap Venture

France-based consultancy Capgemini and VC Isai launch fund to back B2B services startups

Capitem exits Novencia in management buy-back

GP sells stake in consulting firm Novencia back to the founding director, who becomes sole owner

Arkéa backs Groupe Vert, bolts on Netvime

Arkéa finances the merger of the France-based eco-friendly cleaning services providers

Andera exits Erget in management buy-back

Erget is the 11th divestment from Andera's Cabestan vehicle, which closed on €113m in 2011

PE-backed Raffin bolts on Maison Milhau

Combined business of meat food products is expected to generate revenues of €80m

Galiena Capital acquires Cameo Energy stake

GP backs the primary buyout of Cameo Energy, a specialist in energy transition services

Vespa Capital backs Le Marché de Leopold MBO

Company’s founder sells his majority stake, while management invests alongside the GP

Eurazeo's Sommet Education bolts on Ducasse Education

Portfolio company Sommet buys 51% stake in culinary arts and pastry school Ducasse

Arkéa et al. back Children Worldwide Fashion in SBO

Former majority owner Dzeta PE reinvests in the high-end children's ready-to-wear specialist

Ardian buys minority stake in Uptoo

Ardian will support the recruitment platform in completing strategic acquisitions

Future Positive holds first close for debut fund on $57m

Future Positive Capital was founded in 2017 by former Index Ventures executive Sofia Hmich

Seventure Partners invests €3.5m in Domain Therapeutics

Paris-based VC typically provides up to €20m per company, from early to late stage

White Star et al. back €8.9m series-B round for Destygo

Partech Venture, AccorHotels and airports operator ADP reinvest in chatbots developer

Astorg sells M7 Group to trade in €1bn deal

Majority owner Astorg sells Luxembourg-based TV operator M7 Group to French peer Canal+

Naxicap's Stelliant to buy GM Consultant

TGS, a subsidiary of Stelliant, will merge with insurance consulting firm GM Consultant

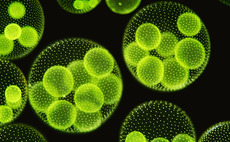

TA Associates' Solabia Group buys Algatech

TA has been a minority investor in natural active ingredients manufacturer Solabia since 2018

Elaia holds €65m close for PSL Innovation

Fund provides seed investments to AI development, deep-tech and deep learning startups

Investors inject €300m in Tikehau Capital Advisors

TCA forms part of the shareholding of France-headquartered asset manager Tikehau Capital

123 IM, Sigma Gestion back L'Usine

GPs acquire a majority stake, investing €4m in the France-based high-end gym operator, L'Usine