France

Partech Ventures in €30m round for EcoVadis

New funding round brings the total raised by the startup since inception in 2007 to $35.7m

CIC Mezzanine 4 closes on €300m hard-cap

Fund's previous generation, CIC Mezzanine 3, gathered €180m in 2013 and is now fully deployed

Argos Soditic buys Sasa Demarle from Weinberg Capital

Weinberg took a majority stake in the group in a deal valued at €92.6m in 2007

Astorg sells Kerneos to Imerys for €880m

Entreprise value represents an 8.8x EBITDA multiple and is expected to close in summer 2017

MBO Partenaires takes 70% stake in Cosmogen

GP first acquired a 51% stake in Cosmogen's parent group Alkos in 2014

Isatis backs Daveo's MBO with €3m

Deal marks first investment by small-cap buyout fund Crescendo, which held a €42m first close this year

Canopia Capital hires Quenardel for investment team

GP continues building its team following its name change from Corvm Capital in September

Partech holds final close for Entrepreneur II on €100m

Total of €30m has already been deployed in 53 transactions

Seventure sells MinuteBuzz shares to TF1

French media group TF1 has acquired a shareholding of more than 50% in the group

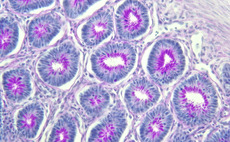

Meusinvest, Spinventure in €4m round for PDC Line Pharma

Round included €2.6m equity and €1.4m in bank loans, EU funding and French and Belgian regional funding

Amundi targets €250m for new European investment programme

An €136m EV investment marked the first deal made through the programme

French PE sees higher valuations in 2016 as dealflow drops

Increased competition and readily available debt lead to multiples creeping up in the country

Women's presence growing in French PE

Alexandra Dupont, president of AFIC's women's association AFIC avec Elles, says the trend towards diversity is encouraging

CM-CIC Investissement takes over La Croissanterie

CM-CIC takes over the majority stake acquired by Pragma Capital in 2006

360 Capital, Breega in €3.3m series-A round for Exotec

New round follows a €340,000 seed round raised in December 2015

NextStage launches IPO with plans to create evergreen fund

Investment firm hopes to reach an equity capital of €500m by the year 2020

Ginko leads €100m series-C round for Devialet

Latest funding brings the total raised by high-end speakers business Devialet to around $155m

Omnes Capital targets international investors with partner hire

Omnes appoints Miria Späth Werder as partner and head of international business development activities

Isatis Capital holds first close on €42m for Crescendo fund

GP is planning a final close for summer 2017 with a €100m target

Axio, Capitem and Swen Capital back Securinfor MBO

New investors are acquiring a combined 90% share in the group

Demeter Partners merges with Emertec Gestion

Agreement follows Paris climate agreement COP21 and will see the firm branded as Demeter-Emertec

Siparex appoints Golder and Tremblin as partners

Olivier Golder and Alexandre Tremblin will be joining the firm's mid-market team

Socadif, Brie Picardie, Idia in €15m round for Acrelec

Socadif, Brie Picardie Expansion and Idia Capital Investissement are all Crédit Agricole subsidiaries

Omnes and BPI support Ducatillon's €7.6m BIMBO

Omnes Capital's small-cap investment team led the GP's efforts in the deal