Germany

Deal in Focus: PE backers sell Euro-Druckservice to DPE

Consortium of PE-backers advised by Kartesia has sold EDS to Deutsche Private Equity

Adcuram hires Christoph Schubert

Prior to joining Adcuram, Schubert led Delta Equity-backed Deutsche Fachpflege Gruppe

Elvaston Capital backs eFulfilment

Elvaston generally invests in companies with revenues between €10-80m and acquires majority stakes

Equistone-backed Apogee buys Kopiervertrieb Rhein-Ruhr

Fifth acquisition the company has made since Equistone's original investment in September 2016

Mountain Partners backs €2m round for Volders

Government-backed KfW Bank also takes part in the round, along with unnamed family offices

Rocket Internet sells €660m stake in Delivery Hero

Naspers purchases 22 million shares at €29.50, securing a 23.6% stake in total

Carlyle sells Klenk to Binderholz

GP made the divestment from its special situations mandate, Carlyle Strategic Partners

BayBG et al. sell Torqeedo to Deutz

Deutz is initially investing €100m in E-Deutz strategy, which includes the acquisition of Torqeedo

Ufenau-backed Altano buys Pferdeklinik Kirchheim

GP supported the transaction with equity from the €227m fund Ufenau V German Asset Light

Waterland-backed Atos buys Fleetinsel Klinik Hamburg

Physicians from the clinic will receive shares in the business, amounting to a minority position

Born2Grow leads series-A for Venneos

Seed investors HTGF, the Max Planck Society and private investors also take part

Redalpine backs $3.9m round for Inkitt

Frontline Ventures, Speedinvest and a number of private investors also take part in the round

German election: the industry reaction

unquote" talks to market participants about what the shock surge of nationalist party Alternative für Deutschland could mean for the industry

Nord Holding sells Wemas to Gimv

Sale ends a six-year holding period for Nord Holding, which acquired the company in 2011

HTGF backs Numaferm

European Investment Fund also invested in the round alongside various business angels

MWN leads €1.9m funding round for Coredinate

Previous investors High-Tech Gründerfonds and Bayern Kapital also took part in the round

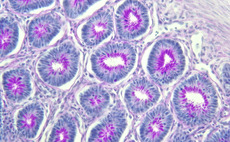

HTGF co-leads €3m seed round for Atriva

Stichting Participatie Atriva co-leads the round, with VC firm InSynchrony Ventures also taking part

IK sells Schenck Process to Blackstone after 10-year holding

Vendor originally purchased the company in a buyout with an estimated EV of €450m in September 2007

Afinum holds final close on €410m hard-cap

GP announced plans to raise a new fund in 2017 when it hired investment director Abdel-Hadi

German election: PE assesses likely coalitions

Coalition between CDU and FDP would be more supportive of private equity by nature

DACH Fundraising Report 2017

Private equity fundraising in the DACH region, as in the rest of Europe, is seeing continued strength

HTGF III raises target and tweaks investment terms

Fund is now operational and will begin making its first investment decisions this week

Creandum and Eight Roads lead $10m series-A for 8fit

Fresh capital will be used for recruitment to support the company's international user growth

Brockhaus sells J&S Automotive to Seafort Advisors

GP made the divestment from its third fund, which has a €175m target and held its first close in 2014