Large-cap buyout

E&Y: Corporates failing to look at PE as potential buyer

Only 3% of corporates surveyed by Ernst & Young for its latest Global Corporate Divestment Study believe private equity funds to be the most likely acquirer should they divest part of their business.

Apollo officially launches new $12bn fund

Global private equity house Apollo Global Management has started marketing its eighth buyout fund with a $12bn target, co-founder Josh Harris announced during a presentation at the Bank of America Merrill Lynch Banking and Financial Services conference...

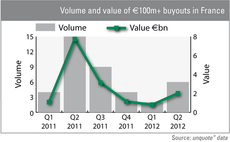

French mid-market on the mend

At long last, activity in the French €100m+ buyout market showed signs of improvement in the second quarter. The Alain Afflelou and St Hubert transactions certainly helped: the former was acquired by Lion Capital in an €800m SBO in May, while Montagu...

AXA PE nears €1bn Fives deal

Charterhouse is set to sell French engineering company Fives to AXA Private Equity and the company's management, according to reports.

Apax leads $1bn Paradigm buyout

Apax Partners and JMI Equity have agreed to acquire oil & gas software vendor Paradigm from US investment group Fox Paine for around $1bn.

Lion Capital buys Alain Afflelou

Lion Capital has entered exclusive talks to acquire French eyewear retailer Alain Afflelou from Bridgepoint, Apax France and Altamir Amboise in a deal believed to be valued at nearly €800m.

Terra Firma buys Four Seasons for £825m

Terra Firma has acquired British elderly and specialist care provider Four Seasons for ТЃ825m.

Rumour roundup: what to expect in 2012

With 2012 just around the corner, the market is abuzz with rumours. Sonnie Ehrendal takes a look at what to expect in the coming year.

KKR buys CSG from Arle for $1.12bn

KKR has acquired safety equipment company Capital Safety Group (CSG) from Arle Capital Partners and Electra Partners, in a deal that values the business at $1.12bn.

Dearth of mega buyouts in Germany

While France, the UK, Sweden and Italy have completed multiple deals over the €1bn mark in 2011, Germany is lagging behind. Susannah Birkwood finds out why

The unquote" forecast: Buyout activity approaches 2008 levels

Propped up by a strong third quarter, European buyout activity should exceed the overall value invested in 2008 by the end of this year, but may fall short volume-wise. Greg Gille reports

Advent buys part of Oberthur for €1.15bn

Advent International has agreed to acquire the Card Systems and Identity divisions of French secure technologies specialist Oberthur for €1.15bn.

2011: The year of the mega buyout

While the increase in volume of European buyouts has been modest in 2011, the surge in value has been impressive. Viktor Lundvall investigates

Apax and Bridgepoint team up again on CEP buyout

Apax Partners and Bridgepoint Capital are teaming up to buy French mortgage insurance services company Compagnie Européenne de Prévoyance (CEP) from PAI Partners, according to media reports.

German buyouts: the giant stirs?

Despite encouraging macroeconomic signs and increasing buyout activity elsewhere, the level of deal completions in the German buyout market remains well below par. What chances are there of an up-tick in this giant market? Julian Longhurst investigates....

Private equity activity subdued despite industry optimism

European private equity remained subdued in early 2010 despite relative optimism over the economy, according to the unquoteт Private Equity Barometer.

EQT's Actavis still in the race for for ratiopharm

According to reports, EQT-backed Actavis is still left in the race for generic drugs group ratiopharm being sold by VEM Vermoegensverwaltung GmbH.

The only way is up: new poll reveals strong optimism for 2010

Most readers are optimistic for the year ahead - but cynics have good cause for concern. By Kimberly Romaine.