Lloyds

Paradoxical two-track market emerging in UK

UK dealflow

Privatisation: private equity's next big opportunity?

As Europe recovers from years of financial instability, many governments across the continent are looking to offload assets in a bid to reduce deficits. Could these potential upcoming state sell-offs provide an opportunity for private equity? Alice Murray...

Rubicon and Grovepoint acquire Goodridge

Rubicon Partners and Grovepoint Capital have jointly acquired fluid transfer and hydraulic systems manufacturer Goodridge through investment vehicle RG Industries.

Acquisition finance: breaking with tradition

Acquisition finance

Acquisition finance: alternative thinking

Despite bringing much-needed liquidity and competition to the debt market, many GPs are still wary of alternative lenders. Alice Murray pits traditional lenders against these alternatives to find out which has the upper hand.

PE-backed Caffè Nero in £275m refinancing

Hutton Collins-backed CaffУЈ Nero, a UK-based coffee shop chain, has completed a ТЃ275m refinancing comprising senior and mezzanine debt.

Lloyds sells SWIP to Aberdeen Asset Management

Lloyds Banking Group has sold asset manager Scottish Widows Investment Partnership (SWIP) to Aberdeen Asset Management in exchange for Aberdeen shares currently worth ТЃ560m.

Inflexion buys On the Beach from Isis for £73m

Inflexion Private Equity has acquired online travel agent On the Beach in a ТЃ73m secondary buyout from Isis Equity Partners.

Lloyds, HSBC, GE team up for Côte funding

CBPEтs acquisition of CУДte Restaurants earlier this month received debt financing from Lloyds Bank Commercial Bankingтs Acquisition Finance team, the HSBC Leveraged Finance team and GE Capital.

Lloyds Bank hires HSBC and RBS directors

Lloyds Bank Commercial Banking has appointed Dave Furlong of HSBC and Kate Grimoldby of RBS to its north of England acquisition finance team.

Baker Tilly picks up RSM Tenon in pre-pack deal

Baker Tilly has acquired RSM Tenonтs trading business in a pre-pack deal following a write off of the embattled companyтs ТЃ80m debt.

Lloyds appoints new acquisition finance director

Lloyds Bank Commercial Banking has hired Eric Jenkins as a director in its acquisition finance division.

BGF appoints former bankers Widdall and Norman

Matt Widdall, BGF

Graphite tucks into Hawksmoor

Graphite Capital has succeeded in its bid to acquire Hawksmoor, supporting the high-end steak restaurant group's management buyout.

Lloyds' Rablen joins Investec

Paul Rablen, Investec

Corsair's Davies eyes Lloyds

Former trade minister Lord Mervyn Davies, vice-chairman of US-based private equity firm Corsair Capital, is in the midst of assembling a group of investors to acquire a ТЃ10bn stake in Lloyds Banking Group, according to reports.

High-yield Q&A: Lloyds' Ian Brown and David Whiteley

High-yield Q&A

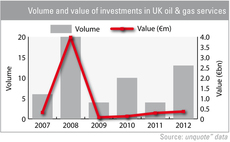

Private equity to benefit from oil & gas boom

The high price of oil could provide a boom to many operating in the oil & gas sector in the UK, and private equity players are looking to take advantage of the opportunities it offers.

TPG-backed retailer Republic enters administration

British clothing retailer Republic, owned by TPG Capital, has appointed Ernst & Young as its administrator.

Axa and Permira's Odigeo completes refinancing

Odigeo, the online travel agent backed by Permira and Axa Private Equity, has placed €325m worth of five-year secured bonds to refinance its senior debt.

Cerberus buys Admiral Taverns from Lloyds

US private equity firm Cerberus Capital Management has acquired UK-based tenanted pub group Admiral Taverns from Lloyds Banking Group.

Sun European Partners buys Paragon Print & Packaging

Sun European Partners has acquired a majority stake in British label maker Paragon Print and Packaging from Equistone, LDC and the management team.

Triton ups European Directories stake

Triton Partners has increased its stake in commercial search directory business European Directories to 50.1%, following the company's debt restructuring.

GTCR acquires Premium Credit

Chicago-based GTCR has acquired UK payment facilitation company Premium Credit from MBNA Europe for ТЃ900m.