Mid-market buyout

Metric acquires Danish lingerie chain

Metric Capital Partners (MCP) has bought a qualified minority stake in Copenhagen-based retail firm Change of Scandinavia, in a deal that values the business at around тЌ70m.

Enterprise closes Polish Enterprise Fund VII on €314m

CEE-focused GP Enterprise Investors has closed its latest fund, Polish Enterprise Fund VII (PEF VII), on €314m.

Rothschild holds €235m first close for private debt fund

Rothschild's Five Arrows Credit Solutions (Facs), a debt fund focused on the western European mid-market, has held a first close on €235m.

Holding periods stretching amid tough exit environment

Holding periods

PE and trade players neck-and-neck on mid-market pricing

Mid-cap valuations

Lower mid-cap renaissance for London in 2012

London was home to a noticeable dealflow uptick in the ТЃ5-50m segment last year, with both activity volume and overall value up by more than 30% on 2011 figures.

LDC marks hat-trick with Ramco investment

LDC has backed the buyout of Scotland-based oil & gas services business Ramco, the third deal announced by the firm in quick succession.

LDC backs NRS Healthcare MBO

LDC has taken a stake in the ТЃ24m management buyout of NRS Healthcare, the healthcare division of listed multi-channel retailer Findel plc.

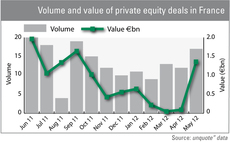

Lower mid-market buyouts hit €2bn record in January

France and the UK led Europe in January in the lower mid-market, which saw 18 such transactions across Europe worth a combined €1.9bn - the largest monthly value witnessed for a year. Greg Gille reports

Mid-cap valuations pick up in Q4 2012

Mid-cap valuations

ECI promotes Lewis Bantin to partner

ECI Partners has promoted Lewis Bantin to partner within the firm.

TowerBrook closes fourth fund on $3.5bn

TowerBrook Capital Partners has held a final close for its fourth buyout fund, reaching its $3.5bn hard-cap.

New German GP Rantum Capital targets mid-market

A group of German businessmen, including former Morgan Stanley Germany CEO Dirk Notheis, have founded a new private equity firm named Rantum Capital.

Mid-cap valuations dragged down by trade buyers

Valuations down

UK lower mid-market resilient in 2012

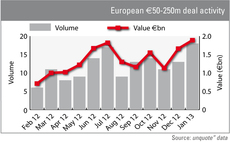

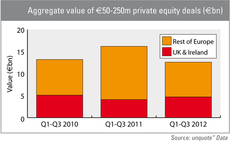

While activity in the тЌ50-250m segment has failed to improve on 2011 figures on a pan-European level, the UK is proving to be fertile ground for deal-making in an otherwise troubled macroeconomic environment.

Siparex raises €90m for mid-market vehicle

French GP Siparex has held a first close for its MidMarket III vehicle on €90m.

IK takes over AXA PE's Unipex

IK Investment Partners has acquired a majority stake in French speciality chemicals business Unipex Group from AXA Private Equity.

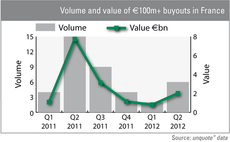

French mid-market on the mend

At long last, activity in the French €100m+ buyout market showed signs of improvement in the second quarter. The Alain Afflelou and St Hubert transactions certainly helped: the former was acquired by Lion Capital in an €800m SBO in May, while Montagu...

Mid-cap GPs pay less than corporates as entry multiples drop

For the first time in two years, between April and June, private equity houses paid a lower median entry multiple than corporate buyers in mid-cap transactions, according to the latest Argos Mid-Market Index.

Latest DBAG fund holds €451m first close

Deutsche Beteiligungs AG has held a first close on €451m for its mid-market buyout fund DBAG Fund VI, two months after sending out PPMs.

French activity: Out of the trough?

Shored up by an uptick in mid-market buyout activity, French dealflow has shown encouraging signs of recovery in May. But subdued activity in the first months of 2012 and a lack of visibility on macro-economic trends should take their toll on year-end...

Mid-cap valuations register modest drop – Argos Index

Modest drop in mid-cap valuations

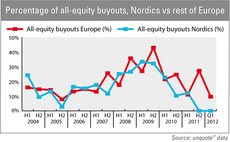

Nordic credit remains more readily available

The Nordic countries have enjoyed a lower proportion of all-equity buyouts than the rest of Europe for several months now - highlighting easier access to leverage in the region.

Buyout market could see worst year since 2009

Latest figures show Europe's buyout market has failed to recover from the market malaise of late 2011, brought on by the Eurozone crisis, particularly at the upper end of the market.