Holding periods stretching amid tough exit environment

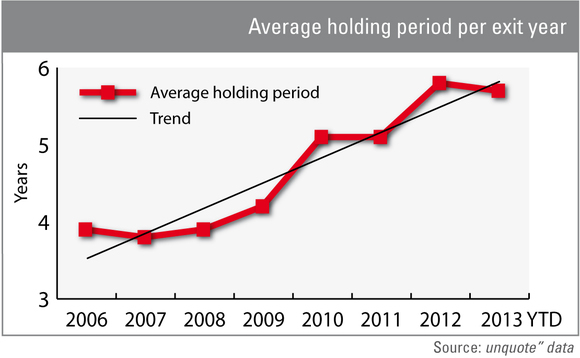

New figures from the unquote” database reveal the average holding period for private equity-backed buyouts has climbed steadily from 2006 onwards, to settle at 5.8 years for deals exited last year. Greg Gille reports

The lengthening holding period phenomenon is often discussed, but a glance at unquote" data, the unquote" proprietary private equity database, shows that the extension of holding periods past the industry standard of five years is indeed noticeable: European assets sold in 2012 have been in GPs' hands for 5.8 years on average since their original buyouts, compared with just 3.9 years for investments realised in 2006.

Holding periods started lengthening slightly in 2009 (4.2 years) and passed the 5-year mark in 2010. Investments realised so far in 2013 display roughly similar holding periods compared with last year, with a 5.7-year average period of private equity ownership prior to exit.

It should be noted that this average hides significant disparities within the sample: for instance, NVM Private Equity sold British automated lubrication producer Interlube Systems in March following a 12-year holding, while Encore Capital sold online cycling retailer Pro Bike Kit to The Hut Group in January after barely a year at the helm.

But as a rule of thumb, many in the industry point at difficulties both in the fundraising and exit environments conspiring to discourage buyout houses from letting go of boom-time investments. "Many outfits that aren't likely to raise their next fund – and I'd say there are more than one might think – have no incentive to settle for a lower price and sell, when they could hold on and keep collecting management fees," a deal-doer recently told unquote".

Rain check

Although this particular situation is arguably extreme, even healthy GPs can be tempted to postpone sales should offers not match their current – and sometimes lofty – expectations. Indeed, "Stop/start" processes continued to be a fixture last year and were partly blamed for 2012's lacklustre dealflow. Charterhouse's Elior could be seen as one of the latest examples: the sale process was rumoured to have been put on hold earlier this year as it only attracted one joint bid by BC Partners and CVC, which came in below the vendor's €3.5bn target.

And Elior is far from being the only boom-time investment growing long in the tooth. According to unquote" data, 44% of all European buyouts completed in 2006 are still in private equity hands, while an even more significant 57% of investments done in 2007 are yet to be realised.

Some stretch back further still. Apax and Permira are nearly a decade on from their take-private of New Look, a low-cost UK fashion retailer. The two each invested £100m in 2004 to take the company private in a £700m deal alongside the company's founder Tom Singh. There is no exit in sight, despite several attempts: in 2009 a new chairman was brought on board ahead of a float, but this was scrapped in 2010 and a series of profit warnings ensued. Then, in 2011, a new CEO was brought on board. Last year, rather than sell, Apax and Permira worked with creditors to extend the life of £300m of senior loans (due later that year), and earlier this year the GPs launched an £800m bond offering to deleverage the business. This latest move has extended the life on PIK notes from 2015 to 2018.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds