Secondary buyout

Trade buyers buoy mega-exit market

While large buyouts have been a rare creature in private equity since the eurozone crisis exploded last year, the mega-exit is making a strong return to the fold, according to research by unquote” data.

BC Partners buys Aenova from Bridgepoint

BC Partners has acquired German pharmaceutical manufacturer Aenova Group from Bridgepoint in a transaction understood to be valued at slightly less than €500m.

21 Centrale buys Cleor off Azulis

21 Centrale Partners has taken a majority stake in the management buyout of French jewellery retailer Cleor.

3i sells Esmalglass to Investcorp

3i has sold ceramic and enamel producer Esmalglass-Itaca to Investcorp in a deal understood to be worth around €200m.

AXA PE acquires frostkrone from Argantis

AXA Private Equity has acquired German frozen finger food producer frostkrone and its subsidiary Bornholter in an SBO from Argantis Private Equity.

Equistone sells Kermel to Qualium

Qualium Investissement has acquired a majority stake in French fibre manufacturer Kermel from Equistone Partners Europe, which is understood to have reaped a 2.2x money multiple on the sale.

AXA PE acquires Fives from Charterhouse

AXA Private Equity has backed the management buyout of industrial engineering firm Fives Group in a deal that values the company at around €850m.

Siparex takes 25% stake in Vulcain

Siparex has acquired a minority stake in the owner buyout of French building fixtures manufacturer Vulcain.

IK buys Actic from FSN Capital

IK Investment Partners has acquired Swedish health and fitness business Actic from FSN Capital.

Oaktree Capital buys Integrated Subsea Services

Oaktree Capital Management has acquired a 62.5% stake in Integrated Subsea Services (ISS), according to reports.

Capvis and Partners Group sell Bartec to Charterhouse

Capvis Equity Partners and Partners Group have sold their majority stake in German industrial safety technology provider Bartec to Charterhouse Capital Partners.

SBOs remain resilient in Q2

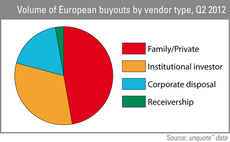

The increase in larger deals witnessed in the second quarter corresponded with a relative resilience in secondary buyout activity across Europe, according to the latest unquote" Private Equity Barometer.

G Square buys Mikeva from Intera

G Square Capital has acquired Finnish social care services provider Mikeva from Intera Partners.

Providence acquires HSE24 from AXA PE

Providence Equity has acquired Germany-based international home shopping group Home Shopping Europe (HSE24) from AXA Private Equity for an estimated €650m.

Verdane Capital Advisors sells Prenax

Verdane Capital Advisors has sold Swedish subscription management company Prenax to French family office Arts et Biens.

AXA PE nears €1bn Fives deal

Charterhouse is set to sell French engineering company Fives to AXA Private Equity and the company's management, according to reports.

Providence to acquire HSE24 from AXA PE

Providence Equity Partners is to acquire a majority stake in AXA Private Equity-held German shopping channel Home Shopping Europe (HSE24), according to reports.

Octopus makes 2.5x money on AVM exit

Octopus Investments has realised its stake in British visual communications systems business AVM through an SBO backed by Alcuin Capital, returning 2.5x money to investors.

AXA PE backs MBO of Arkadin

AXA Private Equity has bought a 45% stake in French collaboration services business Arkadin.

Hellman & Friedman buys Wood Mackenzie in £1.1bn SBO

Hellman & Friedman has acquired a majority stake in UK-based consultancy Wood Mackenzie from Charterhouse in a deal that values the business at ТЃ1.1bn.

ISIS sells Enotria to BlueGem

BlueGem Capital Partners has acquired a majority stake in British wine trade supplier Enotria from ISIS Equity Partners.

Cinven acquires Pronet Güvenlik from Turkven

Cinven Partners has acquired Turkish alarm systems provider Pronet Güvenlik in a secondary buyout from Turkven Private Equity and other institutional shareholders.

LDC acquires Metronet from YFM

LDC has completed the management buyout of UK-based internet service provider Metronet from YFM Equity Partners and Acceleris.

OMERS PE acquires Lifeways from August Equity

The private equity branch of Canadian pension fund OMERS has acquired British healthcare services provider Lifeways from August Equity.