Switzerland

Ardian acquires Sintetica

In 2018, Sintetica reported revenues of CHF 75m, up from approximately CHF 60m in 2017

EQT, ADIA to acquire Nestlé Skin Health in CHF 10.2bn deal

Auction process saw KKR, a consortium of Advent International and Cinven, and Unilever as bidders

Buy-and-build drives consolidation in DACH

Last year saw the second highest volume of bolt-on deals in the DACH region in the post-2008 era

VCs sell Therachon to Pfizer for $810m

Pfizer will acquire Therachon for $340m with $470m in additional, conditional payments

Panakès Partners in CHF 9.5m round for SamanTree

Panakès Partners is using equity from its Fund I, which invests €5-6m in European startups

Consortium invests CHF 12.5m in Alentis

BioMedPartners, BB Pureos Bioventures, BPI France, Schroder Adveq and HTGF participate in the deal

Unigestion launches second direct investment vehicle

Predecessor fund held a €255m final close in 2017 after 21 months on the road

Battery Ventures-backed AED-Sicad acquires Geocom

Geocom and AED-Sicad will merge and the combined company will operate under a new brand

Ardian to acquire Sintetica

Sintetica recorded revenue of approximately €60m for 2018 and employs around 300 staff

Aurelius exits Granovit

Management led by CEO Andreas Fischer will continue to operationally restructure Granovit

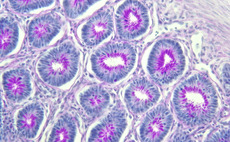

Sofinnova, NEA in CHF 22.5m funding round for Polyneuron

Polyneuron develops biodegradable glycopolymers for the treatment of autoimmune diseases

Ufenau holds €560m close for Ufenau VI German Asset Light

Investors include Banque Pictet & Cie, Argentum Fondsinvesteringer and Wave Management

IK supports Klingel's acquisitions of Bächler, Gehring

Klingel is an IK VIII fund company and was acquired by the firm in 2018 from Halder

Nordic GPs set their sights on the DACH region

Nordic buyout houses are increasing their presence in the region, both in terms of deal activity and boots on the ground

Pureos Bioventures leads CHF 10m series-A for NovaGo

Swiss clinical-stage biotech company Neurimmune also takes part in the investment

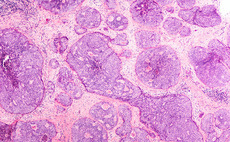

Syncona leads CHF 35m series-A for Anaveon

Anaveon initially received seed funding from the UZH Life Sciences Fund and BaseLaunch

PG Impact Investments holds $210m final close

Firm is independent but has access to Partners Groupтs infrastructure, expertise and resources

Strong LP appetite and creative credit to fuel DACH growth

Despite stiff competition for assets, PE firms in the DACH region hit record deal volume in 2018 and expect further growth in 2019

Altor launches DACH office

Altor recently held the final close of its Altor Fund V on its hard-cap of €2.5bn

Gyrus signs first deal with DowDuPont carve-out

Just four months after being launched, Gyrus Capital has signed the complex carve-out of DuPont Sustainable Solutions

Jacobs Holding sells down stake in Cognita

BDT Capital Partners and Sofina have taken minority stakes in the international school group

Equistone makes new hire and seven promotions

Promotions and appointments take place across offices in France, Germany, Switzerland and the UK

Polytech, Investiere lead €2.8m series-A for Kiwi

Swiss impact funds Symbiotics and 1to4 Foundation also take part in the financing

Insight invests $500m in Veeam

Canada Pension Plan Investment Board joins in funding round for data management software company