Switzerland

Summit Partners invests $37m in Appway

Growth capital investment in financial software company will support its international growth

Invision-backed Schneider Group bolts on Nova Traffic

Add-on is part of a succession solution for the Switzerland-based logistics and delivery company

G2VP leads $80m series-C for Scandit

New funding will be used to accelerate growth in new markets such as Asia-Pacific and Latin America

Six Fintech Ventures leads €4.3m round for PXL Vision

Also participating in the round were High-Tech Gründerfonds, ZKB, Arab Bank and two business angels

Invision sells Vantage Education

Sale ends a seven-year investment period, during which the GP backed five bolt-ons

VI Partners Swiss Innovation fund holds €71m first close

VI Partners also manages Venture Incubator, an evergreen investment platform launched in Switzerland in 2002

Herkules Capital sells sportswear retailer Odlo

Sportswear retailer was acquired by the GP in 2010 and its sale follows a process initiated in 2018

Capvis-backed Variosystems buys Solve Engineering

Add-on of Swiss market peer is the first in Capvis's investment period and in the company's history

MVM Partners leads $62m round for SkyCell

Investors including the Swiss Entrepreneurs Fund also back the pharmaceutical containers producer

Lingfeng Capital leads CHF 14m series-B for Crypto Finance

Switzerland-based cryptocurrency firm mandated PwC to seek new investors for the funding round

Blockchain Valley Ventures gears up for new fund launch

Swiss venture and advisory firm BVV backs companies in the blockchain and emerging fintech space

Halder buys Sirag, Univer and Uniprod

Add-ons to the portfolio companies and Drumag and EPH will expand the buy-and-build Valeta Group

Moravia Capital hires Lambert as partner

Harry Lambert joins the placement agent after more than three years at DeBere Capital Partners

How DACH players are adapting to ESG

ESG has become a key concern for GPs and LPs alike in the German market, but the approaches to it still differ

Lakestar holds final closes totalling $735m

Lakestar Growth I will target late-stage rounds, while Lakestar III will focus on early-stage

Unquote Private Equity Podcast: DACH fundraising special

The Unquote Private Equity Podcast hosts Paul Tilt and Harriet Matthews to discuss the findings of the latest DACH Fundraising Report

DACH Fundraising Report 2020

DACH private equity fundraising was in rude health in 2019, with 26 funds securing a combined €13bn across all strategies for the region

Cerberus sells Covis Pharma to Apollo

Sale ends a nine-year holding period for the GP, which built Covis through a series of acquisitions

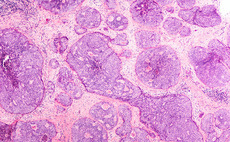

Consortium in CHF 23m series-C for Lunaphore

Fresh capital will be used for market and product expansion in the US and Europe

Unigestion launches Secondary V

Latest vehicle will target non-auctioned small and mid-market secondaries opportunities

DACH VCs introduce sustainability clause

VCs and their portfolio companies will commit via a term sheet and shareholder agreement clause

Partners Group nears $100bn in AUM

Alternatives manager has secured $7.1bn in new commitments from private equity, and $4.9bn from private debt

MTIP leads $21m series-B for Oviva

New investor Earlybird and existing investors Albion VC, F-Prime and Partech also participate

Mirabaud launches second PE fund

Fund will target sustainable investments and new technology in lifestyle-focused businesses