Switzerland

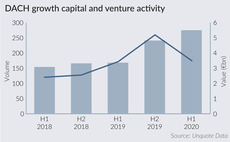

DACH venture and growth deals reach volume high in H1 2020

Growth and VC deal volume exceeded that of all previous half-yearly figures, although average deal size and fundraising activity declined

Occident leads CHF 5.1m series-A for Hemotune

Also backing the biotech startup were the Zürcher Kantonalbank and Greencross Medical Science Corp

Versant Ventures invests $30m in Matterhorn Biosciences

Versant has launched the T-cell therapy developer in partnership with the University of Basel

Verium-backed Tavola acquires Frische und Service

Tavola already owns Frische und Service's Swiss market peer Ceposa, which it acquired in 2018

Permira buys majority stake in EF Kids & Teens

Switzerland-headquartered company runs language schools and online learning in China and Indonesia

VC-backed Pricehubble buys Checkmyplace

Pricehubble has received investment from VCs including BtoV and Helvetia Venture Fund

Ufenau's Swiss IT Security buys Keyon

IT security firm has made 13 add-on acquisitions since Ufenau's investment in November 2017

Energize Ventures backs $10m Beekeeper series-B extension

Latest round for Switzerland-based remote working software brings its series-B total to $60m

Pictet closes Monte Rosa V on $1.164bn

Earlier funds have generated a net IRR of more than 13% and a TVPI of 1.65x

DACH fundraising update: H2 2020 pipeline

Although the coronavirus pandemic has set back plans for many GPs, a number of buyout and venture vehicles are on the road in the DACH region

Allegra buys two printing companies from Sandoz Family Foundation

Switzerland-based Genoud and Italy-based Musumeci focus on printing for luxury goods industries

Invision's Schneider to buy Apriori Transport & Logistics

Freight service makes its second bolt-on of 2020, having acquired Nova Traffic in May

Capiton-backed CymbiQ Group buys Aspectra

Deal is the third bolt-on for the IT service in its cybersecurity buy-and-build strategy

M&A wave incoming in 2021, says Edmond de Rothschild CIO

Investment bank's H2 2020 outlook also emphasises continuing macroeconomic uncertainty, and singles out healthcare and data assets as winners

Equinox closes third fund on €360m

Equinox III targets Italian companies operating in the food, retail, technology and healthcare sectors

Unigestion announces closes for Secondary V and Direct II

Secondary V has held a first close on €228m, while Direct II held a third close on €375m

Longitude Capital leads $40m round for Polares Medical

Existing investors Decheng, Endeavour Vision, IDO, Earlybird and Wellington also take part

Waterland's Tineo bolts on Netrics

Consolidation strategy in the Swiss IT consultancy sector also saw Tineo acquire Nexellent in 2019

Evoco holds €93m first close for third fund

GP buys bundles of three or four assets in one transaction and is optimistic about opportunities

Water Street and JLL acquire Solvias

GPs have assisted with the recruitment of new members to the pharmaceutical research company's board

Wenvest Capital leads CHF 8m round for Teylor

Sternbeis, business angels and institutional investors also back the SME digital lending software developer

Ardian buys minority stake in ProduceShop

GP invested in the e-commerce indoor and outdoor furniture company via its Ardian Growth strategy

CGS Management buys Kalt Maschinenbau

GP aims to follow a buy-and-build strategy for the Switzerland-based cheese-making machinery company

EGS invests CHF 50m in Spineart

Ernst Göhner Foundation joins Gimv as a minority investor in the spinal surgery company