Take Private

Advent takes Eko private

Advent International has secured subscriptions for 97.98% of Polish supermarket chain Eko Holding Group in its bid to take the company private.

PAI partners acquires Marcolin in €207m LBO

PAI partners has agreed to acquire a 78.39% stake in listed Italian eyewear manufacturer Marcolin at a price of €4.25 per share.

Advent launches takeover offer for Douglas

Advent International has made a tender offer to acquire listed German perfume and books retail group Douglas, which would value the business at close to €1.5bn.

EdRIP and Iris back ProwebCE take-private

Edmond de Rothschild Investment Partners (EdRIP) and Iris Capital have backed the take-private of French support services business ProwebCE, alongside trade player Edenred.

Mediq deal to boost 2012 P2P figures

The planned €775m takeover of Dutch pharma company Mediq by Advent could help boost public-to-private (P2P) activity figures, which have been on the wane since 2010.

Advent to take Mediq private for €775m

Advent International has announced plans to delist Dutch pharma company Mediq from the Euronext Amsterdam, valuing the company at €775m.

Carlyle launches takeover bid for vwd Group

Carlyle is looking to take German market data provider Vereinigte Wirtschaftsdienste (vwd Group) private.

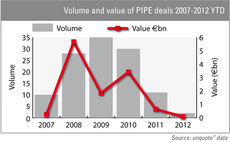

Stock markets blocking the PIPE

The number of investments by private equity funds in publicly traded shares has fallen significantly in the past two years as the stock market has detached from measures of GDP, according to figures from unquote” data.

Takeover rumours send M&S shares soaring

CVC Capital Partners has emerged as a suitor for listed UK-based retailer Marks & Spencer (M&S), with rumours of a potential take-private sending the company's share price soaring on Friday.

LDC takes Boomerang private

LDC has acquired AIM-listed media production company Boomerang in a take-private worth close to ТЃ8m.

OTPP looking to score Goals Soccer takeover

The Ontario Teachers' Pension Plan (OTPP) is set to buy listed UK-based Goal Soccer Centres, which operates five-a-side football centres, in a deal that values the business at around ТЃ73.1m.

Francisco Partners takes Kewill private

Francisco Partners has acquired British logistics software provider Kewill, previously listed on the London Stock Exchange.

Trade player considering rival bid for TPG target GlobeOp

Financial software and services company SS&C Technologies is set to outbid TPG Capital's offer for fund hedge fund specialist GlobeOp.

CVC and ValueAct approach Misys

CVC Capital Partners and ValueAct Capital Master Fund, the largest shareholder in Misys, are said to be considering a joint cash offer for listed software business Misys.

CVC and Phoenix talks break down

CVC has ended takeover talks with life assurance consolidator Phoenix Group after failing to agree on valuation.

Norvestor to take Inmeta Crayon private

A take-private of Norwegian technology consultancy Inmeta Crayon by Norvestor draws closer as significant shareholder CapMan accepts a public offer.

LDC in £41m Workplace Systems take-private

LDC has completed the ТЃ41m take-private of Workplace Systems International plc, a UK-based cloud workforce management solutions provider.

Nordic Capital bids for Orc

Nordic Capital has made a bid for NASDAQ OMX-listed financial technology and service provider Orc Group.

P2Ps to rise – despite Code changes

Changes to the UKтs Takeover Code came into play two months ago. Despite rhetoric, interest in P2Ps is up. Kimberly Romaine reports

First Reserve invests €300m in Abengoa

US private equity firm First Reserve Corporation has invested €300m in listed Spanish technology company Abengoa as part of a capital increase.

Sun European takes struggling Alexon private

Sun European Partners has acquired UK-based fashion group Alexon from administrators, following its delisting from the London Stock Exchange.

eFront to be taken private

Francisco Partners has acquired a majority stake and voting rights in eFront with the aim to take it private.

EdRCP in Groupe Moria take-private

Edmond de Rothschild Capital Partners (EdRCP) has acquired 85.27% of listed French medical equipment company Groupe Moria, with a view to take it private.

A third of deals in doubt from September

Recent changes to the Takeover Code would have impacted 32% of UK deals since 2005. But if properly considered, P2Ps will still be do-able. Kimberly Romaine reports.