Venture

Women in VC: MMV's Brunet on tech opportunities and navigating volatile markets

Alix Brunet speaks to Unquote about the VC firmтs deal pipeline and how it is engaging with portfolio companies and new founders

Newly launched Utopia Capital aims to deploy EUR 10m-plus by 2028

Angel investor Christian Schroeder's new investment vehicle will support early-stage tech companies addressing humanitarian issues

VC Profile: HTGF optimistic on seed stage opportunities as exit environment toughens

German seed investor secured almost EUR 500m for its fourth and biggest fund to date at a time when VC funding is slowing down

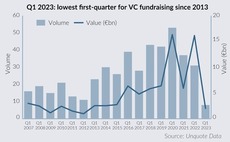

VC fundraising sinks further with lowest Q1 in a decade

Eight European firms secured just over EUR 2bn in commitments in Q1 2023 as continuing uncertainty suppresses LPsт risk appetite, but fundraising pipeline looks promising

VC Profile: Hi Inov in pre-marketing for next fund, outlines plans to wrap up Fund II investment period

France and Germany-based early-stage investor has made 15 of its up to 20 planned investments from its EUR 100m Fund II

Infravia aims to raise up to EUR 1bn for next growth fund, eyes mid-2024 launch

French sponsor expects to raise EUR 750m-EUR 1bn for B2B tech-focused second growth fund

VC Profile: Target Global assesses B2B opportunities in final stretch of current fund deployment

Nearing full deployment for its second growth fund, pan-European VC firm outlines plans to back defensive B2B models and institutionalise its co-investment strategy and LP base

EQT closes LSP Dementia on EUR 260m hard cap

Series A-focused fund exceeded its EUR 100m target and extended fundraising after increased LP interest in its strategy

Newton Biocapital heads for year-end close for second, EUR 150m life sciences fund

Belgian-Japanese VC has raised EUR 50m to date and is lining up exits from its debut fund

Sofinnova launches digital medicine strategy

Life sciences sponsorтs sixth strategy will deploy EUR 2m-EUR 8m tickets in seed and Series A

Nekko aims to reach EUR 10m hard-cap for N Venture I within six months

Spanish VC firm plans to build on the vehicle’s EUR 6m first close, with nine companies backed so far

GR Capital in 'active stage' of USD 50m-USD 70m fundraise

Berlin-based, Ukrainian-owned VC firm could invest up to USD 30m in 2023, targeting a range of technology subsectors

Euroventures scans CEE for tech-based B2B targets, plans new EUR 100m fund

Fundraising for Budapest-based sponsor's sixth fund is expected to start in H2 2024

Planet A raises EUR 160m for debut greentech fund

German VC will back scaleable hardware and software startups, giving science team "veto power" in investment decisions

Series A rounds likely bright spots in VC investing in Q1 2023 – KPMG

Energy security, ESG deals to continue apace, with consumer-focused businesses seeing most strain

Practica Capital aims for EUR 80m hard-cap for third fund

Lithuanian VC investor could hold second and final close in May or June next year

Highland Europe leads EUR 60m round for Le Collectionist

France-based luxury holiday company is aiming for market consolidation following the fresh funding

EQT closes Europe's largest VC fund with EUR 1.1bn raised

Registered in September, EQT Ventures III is almost double the size of its predecessor

Hambro Perks holds first close for debut venture debt fund

B2B software and patented hardware-focused fund is more than halfway towards its GBP 100m target

Startup Wise Guys gears up for B2B fund close next year

Estonian VC is targeting institutionals, family offices and HNWI for EUR 20m Challenger Fund II

Iris Ventures preps new fundraise as Fund I nears final close

Spanish firm's debut vehicle closes in on EUR 100m target; institutional LPs eyed for new fund

Fasanara targets USD 110m first close for new fund by year-end

UK-based investor in talks with institutional investors to close USD 350m VC vehicle in H1 2023

500 Emerging Europe set for EUR 70m fund close by year-end

Turkish VC’s second early-stage vehicle has so far received more than EUR 50m in commitments

Capricorn Partners seeks EUR 25m for industrial biotech VC fund

Belgian GP plans year-end final close after raising EUR 10m from InnovationQuarter and chemicals group DSM