Venture

Contrarian Ventures targets EUR 100m hard cap for new climate tech fund

Lithuanian VC aiming to attract funds-of-funds for second close planned for the next month

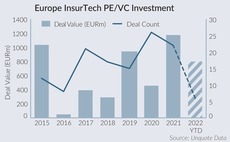

Sidekick spinoffs: Insurtech scale-ups attract PE interest

Investment set to break EUR 1.1bn mark this year as sponsors seek for rising stars

World Fund leads EUR 128m raise for quantum computing group IQM

Series-A2 for Finnish startup focused on combating the climate crisis also backed by the EIB

LongeVC mulls 2023 fundraise for second fund

Biotech-focused VC could hit the road for new USD 180m-200m vehicle once Fund I’s hard-cap is reached

Cipio holds EUR 202m final close for Fund VIII

Technology growth capital and primary buyout vehicle plans to make four to six deals per year

LP Profile: Novo Ventures ready for steady deployment amid IPO lull

Danish biotech investorтs Naveed Siddiqi on opportunities arising from larger funding rounds and benefits of a two-pronged investment strategy

Force Over Mass leads GBP 115m round for Outfund

UK revenue-based lender also supported by PostFinance, 1818 Venture Capital and Tribe Capital in the fundraise

MassMutual Ventures starts European deployment with USD 300m Fund III

New vehicle will focus on leading Series A rounds in digital health, fintech, enterprise SaaS, and cybersecurity

GP Profile: Nordic Alpha Partners on hard-tech, hypergrowth mode

Co-founder Laurits Bach SУИrensen tells Unquote about the Danish growth investorтs value creation model and plans for future investments

Elkstone Partners holds EUR 75m first close for start-up fund

Vehicle aims to reach EUR 100m hard-cap by November and will back up to 35 companies

Verdane leads USD 190m growth round for Instabox

Sponsor will roll its stake in Porterbuddy, which was recently acquired by Instabox, and invest new capital in the Swedish e-commerce shipping group

Getir backer Re-Pie launches EUR 70m VC fund

Re-Pie Ventures 1 plans to hold a first close by the end of 2022, general partner Mehmet Ali Ergin said

Inovexus gears up for seed investments in AI, blockchain, metaverse startups

Evergreen fund's LPs include Crédit Agricole, according to Inovexus CEO and founder Philippe Roche

JamJar closes second fund on GBP 100m

JamJar Fund II is the consumer technology-focused first fund with institutional investor backing

Vitruvian makes USD 35m investment in Moonfare

Deal comes shortly after Insight Partners led a USD 125m Series C for the PE investment platform

Trill Impact set for venture fund following Domin appointment

Alex Domin has joined the Stockholm-headquartered impact investor as co-head of ventures

Apax leads GBP 175m round for ClearBank

Clearing and embedded banking platform is the first deal from the GPтs USD 1.75bn Apax Digital II

Dawn Capital eyes two new funds

Software-focused VC makes early-stage deals; its Opportunities funds back its later-stage portfolio

Disruptive leads USD 250m round for Forto

Latest round brings the supply chain and logistics software platform's valuation to USD 2.1bn

Hiro Capital launches new gaming and metaverse fund

More than double the size of its predecessor, the EUR 300m vehicle will make its first deals in April

Digital Horizon set for USD 200m Fund II first close in Q2 2022

VC started marketing the fund in December 2021 and has USD 100m in soft commitments to date

Notion Capital gears up for fifth flagship fund

In addition to its flagship strategy, VC manages Opportunities funds to back its existing portfolio

Backed VC raises EUR 150m across two new funds

Core 2 will make seed deals; Encore 1 will back later-stage rounds for the VC's existing portfolio

Vaaka invests in digital staffing company Bolt.Works

GP will aim to support Finnish digital staffing company in global expansion