Venture

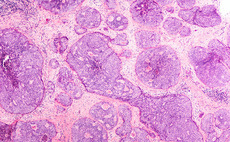

Vesalius, Swisscanto in €19m series-B for OncoDNA

Fresh capital will be used for international growth and software development acceleration

TCV leads $500m round for Revolut at $6bn valuation

TCV is currently investing from its TCV X fund, which closed on $3bn and invests $75-150m

Vertis to launch €120m fifth VC scaleup fund

Fund will target companies with revenues of at least €5m, operating in a wide range of innovative sectors

Wells Fargo in $28m series-B for Elliptic

WFSC joins a group of existing investors that committed to the round in September 2019

Shoe Investments, Knight Venture in €2.75m series-A for Dealroom

Funding will support Dealroom's continued international expansion in Europe and beyond

Prime Ventures, Tempocap in $36m series-B for CybelAngel

Prime Ventures partner Pieter Welten joins the risk management company's board of directors

NGP, ETF in €20m series-B for Shippeo

Fresh capital will be used to further strengthen the company's market position in Europe

Fountain Healthcare invests €5m in Inotrem

In addition, Inotrem receives a €13m credit line from Kreos Capital and a €1m loan from BPI France

Lakestar leads $20m for Impala

Founded in 2016, Impala is a London-based company that builds APIs to connect with hotel systems

GP Bullhound in €4.4m round for Genially

GP Bullhound deploys capital from its fourth fund, which closed on its hard-cap of €113m in 2019

Consortium in CHF 23m series-C for Lunaphore

Fresh capital will be used for market and product expansion in the US and Europe

IVP leads $40m series-B for Aiven

IVP general partner Eric Liaw will join Aiven's board of directors as part of the transaction

83North leads $21.5m round for FloLive

Dell Technologies Capital, Saban Ventures and Qualcomm Ventures also invested in the round

P101 leads €5.6m round for 2hire

Previous backers Invitalia Venture, LVenture Group and Boost Heroes also take part in the investment

Notion leads $36m series-B for Dixa

Dixa's founders have reduced their combined stake by 15-20% in conjunction with the round

Eight Roads and Kennet in £11.5m round for Rimilia

Rimilia secured a new funding facility of ТЃ7m with Silicon Valley Bank in October 2019

Ion Pacific targets $150m for VC secondaries fund

Firm focuses on direct secondaries and LP interests in VC funds, as well as GP recapitalisations

DIP Capital leads €11m series-C for Supermercato24

Previous backers FII Tech Growth, 360 Capital Partners and Innogest also take part in the funding round

SHS backs €6m round for Selfapy

SHS joined the round as a new investor in the online mental health treatment company

Insight Partners et al. back €27m series-C for SimScale

Engineering simulation software provider was also backed by a number of existing investors

Kamet in €6m round for Medloop

Digital health app plans to continue expanding in the UK and Germany following the investment

Smedvig leads $10m series-A for Yumpingo

Company plans to scale its one-minute instant review platform and launch Yumpingo Pay

GreyBella Capital to launch new fund by mid-2020

Fund targets series-A and -B rounds in companies operating in life sciences and complex technologies

EQT Ventures backs $22.3m round for Frontify

Brand management platform plans to use the fresh capital to expand internationally and in the US