Analysis

Unquote Private Equity Podcast: Ready, debt set, go

Listen to the latest episode of the Unquote Private Equity Podcast, dedicated to the latest developments in the private debt market

Concerning prognoses for German healthcare

Uncertainty around new regulation in the healthcare sector has caused jitters among investors

Bet the farm: reaping the rewards in agri-food investing

Investments in the agri-food tech space have bloomed in the past few years, while an increasing number of new players have entered the sector

GPs get picky on LP-led secondaries

Approved-buyers lists have emerged as a way for GPs to assert their power, but may not become commonplace just yet

PE success despite political headwinds in Belgium

Despite concerns related to political instability in the UK and at home, Belgium’s buyout market was in rude health last year

Q&A: Robert W Baird's Terry Huffine

Robert W Baird managing director Terry Huffine talks about the growing appetite for investment in the knitting and yarn industry

European VC catching up to US, says EIF's Grabenwarter

Panellists at the recent Invest Europe Investors' Forum in Geneva extolled the virtues of the European venture ecosystem

Unquote Private Equity Podcast: Sotheby's to PEbay

Listen to the latest episode of the Unquote Private Equity Podcast, in which the team discusses the evolution in the secondary market

Blockchain heralds crypto's second coming

Following the launch of the first securitised token offering to retail investors in the UK, Unquote explores the potential for future VC involvement

LP Profile: Flexstone

Eric Deram talks to Unquote about plans to launch a global fund initiative dedicated to co-investment

Unquote Private Equity Podcast: Training a PE heavyweight

Listen to the latest episode of the Unquote Private Equity Podcast, in which the team looks at what it takes to bulk up a brand ahead of fundraising

Nordic direct lending makes slow but steady progress

Private debt funds have been rapidly expanding their market share in corporate cashflow lending across Europe, but Nordic progress has been slow

LP Profile: Assicurazioni Generali

Group head of private equity investments Sollazzo speaks to Unquote about the insurer’s investment program and plans for 2019

UK private equity anxiety as Brexit crisis intensifies

Twists and turns in the Brexit process are making it increasingly difficult for private equity practitioners to prepare for what lies ahead

GP Profile: Ambienta

Latest flagship fund raised by Ambienta held a final close in May 2018, hitting its тЌ635m hard-cap, exceeding its тЌ500m target

Bifurcation in European fundraising: beat the traffic

Recent years have seen the growing polarisation of fundraising fortunes for GPs, with established managers able to raise faster than their peers

GP Profile: Alantra Private Equity

Spain-based mid-market player has completed six deals in the past 12 months and is focusing on expanding and managing its current portfolio

Q&A: JCRA's Benoit de Bénazé

Some GPs are combatting risks arising from turbulent politics and economic uncertainty by making more frequent use of currency and risk hedging instruments

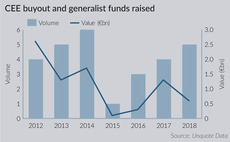

CEE fundraising activity promises buyout revival

Fundraising in the region held strong in 2018 in contrast to the rest of Europe and promises to be even stronger in 2019, even as dealflow slumped

Benelux trade deals surged in 2018

Exits to strategic buyers accounted for 56% of all divestments, with the volume of such deals increasing by 68% year-on-year

Unquote Private Equity Podcast: European tour

Listen to the latest episode of the Unquote Private Equity Podcast, in which the team examines the key takeaways from IPEM and SuperReturn

Germany resists pan-European tech buyout decline

Drop in tech buyouts follows a pan-European trend, as every region besides southern Europe saw a decline

VC activity picks up steam in Spain

Venture capital activity maintained momentum in 2018, largely fueled by international players in later-stage rounds

Nordic GPs set their sights on the DACH region

Nordic buyout houses are increasing their presence in the region, both in terms of deal activity and boots on the ground