Bifurcation in European fundraising: beat the traffic

The past two years have seen an acceleration in the polarisation of fundraising fortunes for European GPs, with large-cap and brand-name fund managers able to raise faster than smaller and less established players. Kenny Wastell reports

There was a significant year-on-year slowdown in European private equity fundraising in 2018, with 65 vehicles holding final closes totalling €53.51bn in commitments, down from 92 raising €80.53bn in 2017. This can be partly attributed to the cyclical nature of private equity fundraising. However, another trend has also emerged, shedding further light on the contrasting fortunes within the fundraising market: larger and more established GPs are launching and closing new vehicles within an increasingly short timespan, while less established and smaller peers are experiencing the opposite.

"We have seen some raises in the past 18 months or so happening very quickly – in around three months of official marketing time – and others taking much longer than they would have done in prior years," says Karl Adam, managing director at placement agent Monument Group. "At one end, a fundraise that would have taken six months in previous years is now taking 12, 16 or even 18 months. The faster raises tend to be from the larger brand-name GPs or lower-mid-market firms that have a clear differentiation and strong track record. The others in a large sea of lower-mid-market firms, which potentially have more mediocre performance, are getting lost in a crowded market."

A recent fundraise that illustrates this trend is the sixth vehicle of UK buyout house Bowmark Capital, which closed on its £600m target – a 60% increase on its predecessor – after just 10 weeks on the road. While this undoubtedly constitutes a rapid process, there have been more extreme cases since the beginning of 2017, such as Netherlands-headquartered Waterland Private Equity, which launched and closed its €2bn seventh fund within a two-month period.

"Almost unlimited capital supply is flowing to a handful of the best managers (both large and small) across all strategies, causing increased bifurcation and competition for prized assets as funds are deployed at greater pace," says Asante Capital managing partner Warren Hibbert. Indeed, of the 10 fastest fundraises to have taken place since January 2017, nine were either flagship vehicles with at least four predecessors, or platform extension plays with at least one like-for-like predecessor. Firms represented on the list include Ardian, TPG Capital, Waterland, Bowmark and Investindustrial and ECI Partners.

It is rational to expect that private equity fund managers with good track records and an established base of LPs might find it easier to secure a group of willing investors. Furthermore, it is to be expected that negotiations and due diligence processes will be considerably smoother where there is an existing historical relationship between GP and LP, thus leading to faster fundraising processes.

In the case of Bowmark, the firm was able to raise its latest flagship in such a short period of time largely due to the fact that 94% of the commitments it received were from existing LPs. Similarly, ECI's 11th flagship fund was "materially oversubscribed", according to the GP, and closed after less than three months, with a re-up rate of around 80% by existing investors.

A source at one international brand-name GP, speaking on condition of anonymity, tells Unquote: "There is definitely a bifurcation and you need to be on the right side of it. It is great for the funds that are, but the rest will struggle. Partly, what is driving it is that the people who were around during the crisis and survived have built the trust of their LPs."

Macro clouds ahead

Firms that survived, and even thrived, throughout the financial crisis are therefore well positioned to weather a widely anticipated downturn in the broader macroeconomic cycle. There is much logic to investors pursuing a "flight-to-safety" approach when selecting where to commit their European private equity allocations currently. In addition to ongoing Brexit-related uncertainty, which, perhaps not surprisingly, is having the largest impact on the UK, economic growth is beginning to wane in Germany and France, while Italy has remained stagnant.

Yet, beyond macroeconomic concerns, the rationalisation of GP relationships within private equity portfolios has been a key theme among institutional investors for around a decade. Faced with the administrative burden of unwieldy pre-crisis portfolios, LPs have used a variety of means to consolidate these to make portfolios more manageable, most frequently by allocating larger ticket sizes to fewer managers.

Almost unlimited capital supply is flowing to a handful of the best managers across all strategies, causing increased bifurcation and competition for prized assets" – Warren Hibbert, Asante Capital

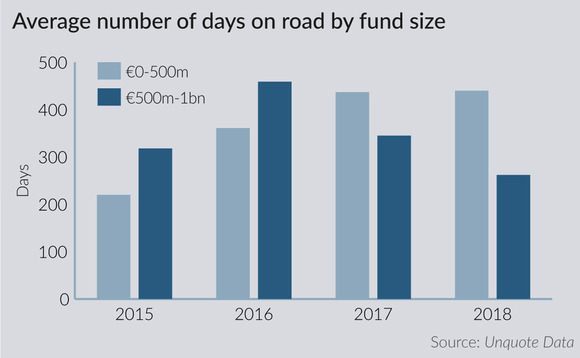

This is reflected in the different pace at which funds of various sizes are raised. Since January 2017, European funds raising total commitments of €1bn or more spent an average of 286 days on the road, 70% of that taken for funds in the €500-1bn range and 63% of the time taken for those in the €100-500m range. This trend is most notable in two of Europe's most established private equity markets, France and the UK. In France, during the same two-year period, vehicles of €1bn or more took just 166 days on average to reach a final close, compared with 680 days for funds in the €500-1bn range and 546 for those raising €100-500m. In the UK, the picture is slightly less extreme, though consistent: €1bn+ funds took an average of 241 days, compared with 343 days (€500-1bn) and 429 days (€100-500m).

Nevertheless, Pantheon partner and European investment team head Helen Steers still sees strong opportunities in the European mid-market. Speaking to Unquote at this year's IPEM conference, Steers said: "There are a lot of really interesting opportunities in the European mid-market. Maybe not in the type of areas you would immediately expect, but anywhere that has experienced a little bit of dislocation. And sector-focused funds could also be an interesting place to start looking."

Two for one

This indicates there is still LP appetite for smaller fund managers, but investors are increasingly able to diversify their private equity portfolios without needing to increase their number of relationships. Specifically, larger established players continue to raise sector-dedicated and smaller-cap funds, in addition to branching out into adjacent asset classes. The anonymous source at a brand-name GP tells Unquote: "Big pension funds and sovereign wealth funds are consolidating their relationships. It is less administrative work, less cost and less risk. When we launched our platform extension we could not guarantee to our LPs that the performance would be good, but we have built their trust and we have proven that we can do it in other areas."

The theory is supported by the LP base of TPG's mid-market vehicle TPG Growth Fund IV, which closed in December 2017 after around three months on the road. Of the 18 investors that Unquote Data has on record as committing to the fund, all bar one are also listed as LPs in other vehicles managed by the GP. Meanwhile, in its 2017 activity report, Ardian revealed that, on average, each of its LPs "now holds more than three Ardian products".

"There is an element of brand recognition with platform extensions," says Monument's Adam. "If LPs have built conviction in GPs initially in their larger funds, they trust them to hire the right team and to apply firm oversight and investment strategy. Provided there is that trust and understanding with a group of individuals built up over time, they are much more likely to back them into a new asset class."

LPs have limited bandwidth to perform due diligence on new funds, and hence are very careful to filter out most funds and focus on a select few per year" - Warren Hibbert, Asante Capital

The consequences of this phenomenon are that top-tier managers are in ever-increasing demand and are able to hit hard-caps in a matter of weeks. For LPs, this places a significant onus on maintaining relationships with preferred managers, which, when it comes to allocation, means re-upping as soon as possible to avoid being frozen out. "The absolute majority of investments are re-ups for LPs," says Asante's Hibbert.

Hamilton Lane, as part of its 2018-2019 Market Overview, discussed looking at around 1,000 PPMs (private placement memoranda) during 2018, and while this likely represents the upper end of the spectrum, many institutional investors will have been inundated with approaches. This means that backing existing managers has an additional benefit to simply maintaining relationships: "LPs have limited bandwidth to perform due diligence on new funds, and hence are very careful to filter out most funds and focus on a select few per year, with re-ups being the obvious starting point, given the developed relationships with those managers and the fact they are not starting from a zero base," says Hibbert.

However, it is also worth noting that larger institutional LPs, which are more highly represented in the funds of brand-name GPs, are also armed with larger teams able to diligence new vehicles at a faster pace, thus potentially skewing the picture slightly. Kai Roolf, a partner at Afinum, says: "In the case of Afinum, we had oral commitments within a matter of weeks, but it took the LPs a while to get across the finish line, which was the point at which we communicated closing. Also, we do not have a single dedicated IR resource, it is all done next to our deal doing. If I compare that to my time in large-cap, the IR team was huge and most investors were institutional, with a large private equity investment team and hence the ability to act swiftly."

First time's a charm

Despite the challenges faced by less established players, European first-time fund managers are still finding some joy on the fundraising trail. Indeed, as Unquote recently reported, €4.48bn was raised across 35 European debut vehicles in 2018, compared with 2017's €5.25bn committed to 16 funds. More notable still, 26 of these funds are vehicles with specific remits to invest in niche segments, as Pantheon's Steers alluded to.

This includes vehicles that invest in segments as diverse as food and beverage, healthcare, leisure and hospitality, fintech, agritech, insurtech, and even one dedicated to companies developing new technologies for the application of transition metals (AP Ventures Fund I). Beyond these 26, the majority of vehicles are geographically focused funds, often with mandates to invest in countries with less established private equity sectors. It is clear that, particularly for new managers entering the fundraising market, specialisation is becoming increasingly key.

If LPs have built conviction in GPs initially in their larger funds, they trust them to hire the right team and to apply firm oversight and investment strategy" - Karl Adam, Monument Group

"We invest in first-time funds and have done so fairly consistently throughout our history," says Steers. "But we do not invest with first-time investors. First-time funds have a lot of advantages; they are not weighed down by the old portfolio, so they tend to have a bit more time. On the other hand, there are a lot of practical issues putting a new fund management group together; they have got to build the team, for instance. And not having a past portfolio can also sometimes be unhelpful, because they do not have some of the natural interaction with intermediaries. But, by and large, we are very open minded and we do enjoy seeing new managers coming into the market because it helps to renew the ecosystem."

Monument's Adam says the key to a successful fundraise by less established players, and the role of the placement agent in such a scenario, typically involves identifying the unique qualities of a firm. Investing time and effort into recognising and articulating differentiation is the only way to stand out in a crowded market.

"One firm from the DACH Mittelstand came to us saying their differentiation was their sourcing from their wonderful network," Adam says. "You have to dig into that and ask: ‘What are those networks? How did you build them? Why are they helpful to your sourcing strategy?' In this case, it turned out they really were focused on founder-owned companies in a specific part of Germany. They had very long-standing relationships with those founders and were able to translate that into really interesting dealflow. Bringing that point out in the marketing materials is far more compelling than just saying: ‘We source through proprietary networks'."

A view to 2019

With the aforementioned macroeconomic indicators pointing towards a slowdown in activity across Europe, industry participants will keep a keen eye on the effect this will have, not just on portfolios and dealflow, but also on fundraising into 2019. It remains to be seen whether there will be further bifurcation of the market, or whether smaller, more agile GPs will be able to attract more of a fair hearing from investors.

Adam says: "In general, people expect to be as busy in 2019 as they were last year. The wave of re-ups seems to be coming in Q1, including some large-cap European names coming back to market. But after that, a lot of LPs expect the re-up wave to drop off a bit. Hopefully, that means more room for new funds as we move later into the year."

Yet the aforementioned anonymous source indicates they do not expect to see a let-up in the bifurcation of the private equity fundraising landscape. "I expect it to continue and increase because we expect a downturn or correction of some kind in the near future, and if that happens people will be more conservative," they say. "It is possible that 2020 will be a very good year if there is a slowdown this year. We do not try to time our funds, but we noticed that 2009 is a very good vintage."

This is something that Monument's Adam also acknowledges. "There is the overhanging risk of a macro-event, which could cause a fairly significant shock to equity markets and the economy in general," he says. "Then people would need to ask themselves how that would affect their approach to fund investment programmes – whether it causes them to look more towards distressed managers or whether the denominator effect of falling public markets will impact their investment pace."

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds