Analysis

Alternative lending thrives in the Netherlands

Only the UK, France and Germany have seen more deals involving alternative debt, with Netherlands activity growing 31% year-on-year in 2017

Italian venture moves upmarket as overall activity dips

Venture dealflow and aggregate value decreased in 2017 following five years of growth, as VCs turned their attention to later-stage rounds

LP direct investment: straight to the source

Limited partners are striking out on their own to source their investments directly, with numeorus new strategies emerging

Nordic tech's transatlantic ambition

Nordic startups are increasingly looking to find backers with ties to the US market to support their growth strategies

Deals accelerate in German online marketplaces

Three transactions in the space within the first two months of 2018 saw PE firms invest a combined €500m and cash out more than €700m

Casual dining: overbooked and undercooked

British PE owners are facing challenges as the sector shows signs of strain due to oversupply and macroeconomic headwinds

Italian private debt issuance jumps 35% in 2017

Southern Europe's two biggest markets differ greatly in their uptake of private debt, with Spanish players facing strong competition from banks

Private debt funds expand market share in Germany

Growing use of use of first-out, second-out unitranche leads to private debt funds more than doubling their share of German mid-market deals

European PE in 2017: Scaling new heights

Buyout activity and fundraising reached a new peak in 2017, with mega-buyouts and small-cap deals fueling dealflow and French funds popular among LPs

Idinvest/Eurazeo merger: Going global

Eurazeo's permanent capital and an international footprint will help Idinvest attract an international LP base

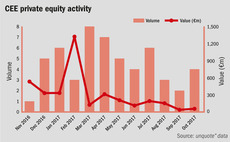

CEE mid-market players welcome renewed attention from larger GPs

Focusing on the mid-market pays off, as renewed interest from international sponsors affords interesting SBO opportunities

Less specialisation in southern Europe as generalists flourish

Trend of fund specialisation has been observed in European PE but LPs are still supporting less differentiated strategies in Southern Europe

DACH auto-parts deals motor on as sector transforms

Private equity players remain keen on auto-parts, as the sub-sector responds to rapid changes brought about by the electrical vehicle market

Secondaries: all systems go following bumper 2017

Following a slump in 2016, the global volume of PE secondary transactions increased last year to reach new records

Canadian pension funds make inroads in France

unquote" looks at Canadian institutional investors' renewed appetite for direct investments in large-cap French assets

Pan-European GPs putting feet on the ground in Benelux

Pan-European GPs seek to tap Benelux's burgeoning buyout dealflow by securing talent familiar with the region

VCs tread cautiously around blockchain craze

VC activity in cryptocurrency has increased, but despite eye-catching deals, their volume is not as high as the wider enthusiasm would suggest

European PE in 2018: beware the bullet

unquoteт brings together a group of leading practitioners to analyse industry developments during 2017 and discuss emerging trends heading into 2018

European PE in 2017: fundraising tailwinds and growing leverage

Industry professionals look back on a resilient year for private equity during a period of turbulent geopolitics

Fundraising record rounds off active year for Nordic region

Region saw strong fundraising and high deal volume off the back of low interest rates in 2017

Tech gains traction in French private equity

Expansion deals and small-cap buyouts fuelled a strong 2017, with tech proving increasingly popular among buyout houses

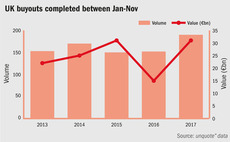

UK buyout activity reaches post-crisis peak in 2017

Small-cap and lower-mid-market invested strongly during the course of the year, while fundraising activity continued apace

Benelux funds specialise to compete with strategic buyers

Record level of commitments were secured by Benelux funds during 2017, with GPs increasingly turning to sector specialisation

CEE closes out 2017 with strong investor confidence

Fundraising and deal activity both increased in the region during 2017