CEE closes out 2017 with strong investor confidence

Fundraising in the CEE region continued apace in 2017, with buyout activity also up year-on-year. Nicole Tovstiga reports

Private equity fundraising in the CEE region has enjoyed significant growth in 2017. In September alone, CEE-focused firm Enterprise Investors raised a €498m fund after only three months on the road, and Abris Capital Partners hit a €500m close for its third fund.

Figures from unquote" data indicate that CEE funds that have held a final close between January and November 2017 raised a total of €1.3bn, up from €892m in the whole of 2016 and €204m in 2015. The fruitful fundraising environment is largely down to positive economic growth and relative political stability in the region.

"For fundraising, it's never been as good as this," says Michal Karwacki, a partner at Squire Patton Boggs. "It's a great time to gather funds by Polish private equity houses in 2017 and to incorporate new private equity houses. Let's hope that trend continues into 2018."

It took Enterprise Investors only three months to raise its consumer-product-focused vehicle, Polish Enterprise VIII, having had an attractive track record with two profitable exits that offered 4-5x returns on investment.

Healthy dealflow

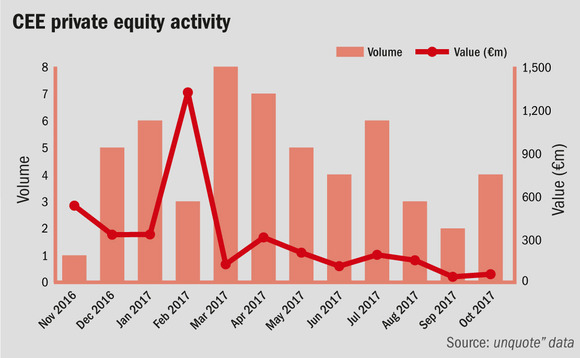

While the fundraising environment gains momentum, the volume of buyouts in the region is also up compared with last year. There were 34 such deals in 2016 compared to 36 in the first 11 months of 2017. Both the small-cap space and the mid-market are proving attractive, in addition to a handful of larger deals that make the headlines annually.

"We have never experienced such a high dealflow as we have in 2017," Genesis Capital managing partner Jan Tauber tells unquote". The CEE-focused buyout firm is headquartered in the Czech Republic and invests in regional companies in the small- and mid-cap ranges. It usually conducts two investments per year, but in 2017 that number increased to four, which Tauber says is unusual.

For fundraising, it's never been as good as this. It's a great time to gather funds by Polish private equity houses in 2017 and to incorporate new private equity houses. Let's hope that trend continues into 2018" – Michal Karwacki, Squire Patton Boggs

He adds that Genesis has a strong pipeline going into 2018. Depending on how investments progress in the year ahead, and if the fund is 80% deployed by 2019, the team will be looking to raise a fifth fund by 2020. The new fund will focus on the Czech Republic and Slovakia, with 20% allocated to investments in neighbouring Austria, Hungary and Poland.

Despite the positive fundraising appetite and increasing dealflow, aggregate value was considerably higher in 2016 – €5.78bn compared with €2.98bn in the 11 months to November 2017 – though this was heavily influenced by a handful of large deals that pushed figures up. The $3.253bn Mid Europa-, Permira- and Cinven-backed buyout of Polish online marketplace Allegro marked 2016's largest CEE transaction and also the largest in the past 10 years. Additionally, the €533m secondary buyout by Mid Europa of Romanian discount supermarket chain Profi from Enterprise Investors in the final quarter of 2016 reflected unusually high deal values in the region.

Smooth start for 2018

The challenge remains luring in new international investors, according to Bill Watson, managing partner at Value 4 Capital, which is currently fundraising for the Poland Plus fund, a vehicle with a hard-cap of €150m. Industry insiders say GPs are cautious about investor appetite, but high returns are encouraging and promoting a general confidence in the region. Nevertheless, in the short term, private equity firms are not expecting immediate changes ahead for 2018.

Dampening the mood further are concerns surrounding entry multiples, which are percolating under the surface. "Valuations of newly acquired companies are high due to high expectations of vendors, meaning acquisitions for GPs could become even more expensive in 2018," Tauber says. This could mean that, by the second half of next year, GPs in the region could have a harder time securing funding in order to buy assets.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds