Analysis

How private equity is dealing with the debt deluge

Despite jitters in the large-cap space, the European mid-market continues to be flooded with financing options

Deal in Focus: Adelis in DKK 250m buyout of SSI Diagnostica

Swedish GP Adelis completes the DKK 250m privatisation of Danish niche pharma company SSI Diagnostica

Danske's Fromm discusses debt trends in the Nordics

Danske Bank's Lars Fromm says the Nordic market will be more balanced this year between IPOs and M&A

In Profile: Ufenau Capital Partners

A look under the bonnet of recently rebranded Ufenau, previously known as Constellation Capital

Startup boom: A wake-up call for Italian VCs

With a continued rise in the number of Italian startups, could local VCs be missing out?

Russian private equity vacuum remains

Despite a funding gap, private equity activity in Russia remains subdued

Strong valuations in Nordic region driving co-investments

With strong pricing in the Nordic countries, GPs are looking to co-invest in order to secure deals

Benelux: New investments slow down while large exits abound

New investments in the Benelux region have been subdued, but a number of large exits have bumped up Q1's figures

The birth of the French pension fund?

The French government’s plans to create a new pension funds regime could ultimately spell good news for private equity

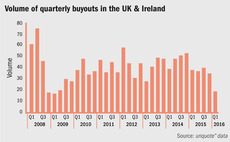

UK buyout activity suffers deepest decline since 2009

The volume of buyouts witnessed so far for the first quarter of 2016 is the lowest on record since 2009

Hidden gems: How German small-cap GPs source deals

While the German M&A market is known for high levels of intermediation, those in the small-cap space take a different approach

Deal in Focus: Trilantic's investment in Maugeri highlights structural healthcare reform

An in-depth look at Trilantic’s third investment in the Italian healthcare sector

SVCA chair Thand Ringqvist on global crises impacting Nordic PE

Elisabeth Thand Ringqvist discusses concerns for the Nordic PE industry, including the migrant crisis

Deal in Focus: Disruptive travel firms are hot Tiqets for VCs

An in-depth look at Capital Mills' investment in mobile ticketing company Tiqets

Deal in Focus: GFC, Project A team up for Pets Deli round

An in-depth look at GFC and Project A's investment in high-end pet food retailer Pets Deli

Deal in Focus: Segulah builds on Stockholm property sector with Zengun

An in-depth look at the Swedish GP's first buyout of 2016

The perfect LP base: A taste of traditional investors

Part three of our LP selection series assesses traditional investors' relationship with the asset class

The perfect LP base: All new flavours

Part two of our LP selection series reveals new investors keen to invest in PE funds

The perfect LP base: Diversification or concentration?

Part one of our LP selection series assesses how diversified an LP base should be, and why

A future of private equity substance

Jersey Finance's Geoff Cook discusses the importance of substance for fund administration

In Profile: Vendis Capital

Vendis co-founder Cedric Olbrechts discusses the advantages of being a sector specialist

Western Balkans buyout activity likely to remain sporadic

Stronger links between the Balkan countries will help investment, but PE dealflow will likely remain patchy

Volatility impacts listed private equity

Discounts to NAV for listed players are beginning to widen as volatility and uncertainty take their toll on the markets

Refinancings surge in Germany

Is the surge in German refinancings – outpacing new deals in 2015 – the sign of a weakening exit market?