Analysis

LP interview: Secondaries come first

LP interview: Idinvest

Portugal's export credentials lure GPs back

Portugal's export edge

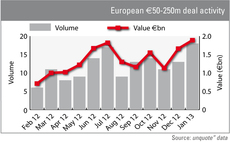

Lower mid-market buyouts hit €2bn record in January

France and the UK led Europe in January in the lower mid-market, which saw 18 such transactions across Europe worth a combined €1.9bn - the largest monthly value witnessed for a year. Greg Gille reports

Mid-cap valuations pick up in Q4 2012

Mid-cap valuations

Austrian private equity market gathers momentum

Austria’s private equity scene could be on the verge of a mini-boom as January’s deal activity has already outperformed last year’s first quarter.

Private equity's biggest scandals

Public image

French retail fundraising down for fourth year in row

France's FCPI and FIP retail vehicles – used extensively by the country's venture and growth capital players – raised €646m last year, down 12% from 2011 figures.

BVCA calls for return of taper relief

The BVCA has called for the return of the controversial taper relief for capital gains tax (CGT) in some cases.

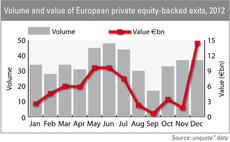

Exit market hits €15bn in December

Almost €15bn worth of capital was realised by private equity portfolio sales in December 2012, the highest amount in the past year, according to figures from unquote” data.

Vendors and banks amenable to strong 2013 in UK

Good signs for 2013

International interest picks up in Central & Eastern Europe

European private equity was abuzz with exits paving the way for fundraisings last year, and CEE was no exception. Kimberly Romaine reports

Italy: Diamond in the rough

Diamond in the rough

Fundraising booms in January

The beginning of 2013 has seen a swathe of fundraising announcements, with several funds reaching their target. Could this trend be a sign that investor appetite for private equity is returning?

Video: Private Equity Partners' Fabio Sattin

Amy King talks to Fabio Sattin, founder and chairman of Private Equity Partners, about why Italy has struggled to attract foreign investment.

France's fresh start

Fresh start

A happy New Year for venture capital?

Happy New Year

UK Watch: Large deals boom in 2012

The final quarter of 2012 saw the highest large deal volume since early 2010, according to the latest unquoteт UK Watch, in association with Corbett Keeling.

German PE faces challenges in 2013

German PE

Q4 Barometer: European deal value up 82%

Q4 Barometer

Nordic private equity's 2012 highlights

Even the strong Nordic economies have struggled in 2012, as their key trading partners in the eurozone suffer under the weight of Greek and Spanish debt. Deal activity is down and Sweden's tax men are keen to take a cut of the private equity industry's...

PE players beat the buy-and-build curse

Buy-and-build

Benelux private equity's 2012 highlights

The Benelux region had a relatively quiet 2012 and little deal activity is expected until the broader European economy improves. However, the deal dearth was eclipsed by other events, including the clean-up of Belgium’s banking sector, the Dutch elections...

Pension funds failing to stick up for private equity

Speaking up for PE