Analysis

BGF - two years on

BGF - two years on

UK Watch: Q1 activity hits five-year low

UK private equity saw its worst quarter since 2009 despite widespread optimism in the market, according to the latest unquoteт UK Watch, in association with Corbett Keeling.

Nordic private equity market undergoes cautious evolution

The Nordic market is changing. Long dominated by the powerhouse economy of Sweden and seemingly impervious to the crisis gripping Europe, 2012 was a tougher year and saw many new developments.

UAE eases rules on private equity fund marketing

United Arab Emirates (UAE) rules have relaxed, making it easier to market private equity funds to investors there.

CEE private equity: undervalued?

CEE: undervalued?

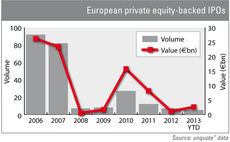

IPO activity dwarfs 2012 after first quarter

Private equity-backed IPOs are making a major comeback and could be set to reach their highest level since 2010, according to figures from unquoteт data.

Family offices set to increase PE allocations

Family offices

Moleskine's public market debut belies Advent's Milan closure

Syntegra's Moleskine, the golden boy of Italian private equity, has listed. But while the local GP revels in the benefits the domestic market affords, Advent International closes its Milan office. Amy King investigates

Apax, Blackstone, Permira and Providence fully exit TDC

The sale of TDC shows that not all investments made during the heady days leading up to the crisis were bad eggs.

Benelux spirits lifted as exits rise

Benelux exits

Eurozone shows greater appetite for Turkish delight

Turkish delight

French private equity back from the brink

Back from the brink

German banking reform threat to private equity

The German government's draft proposals for banking reform, based on the Liikanen Report, are seen by many in the private equity industry as yet another threat from legislators, despite the unclear effect it may have on the asset class. Carmen Reichman...

Moulton predicts 10x increase in dealflow

Q&A: Jon Moulton

Iberian private equity: special report

Enthusiasm for Iberian markets has returned lately, with some international investors in the audience of a recent industry conference citing Spain as the most attractive target for private equity. The government’s structural reforms have reassured GPs...

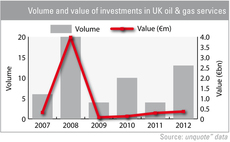

Private equity to benefit from oil & gas boom

The high price of oil could provide a boom to many operating in the oil & gas sector in the UK, and private equity players are looking to take advantage of the opportunities it offers.

Fundraising to improve despite AIFMD

European fundraising is expected to improve in 2013, despite the regulatory burden of the AIFMD, according to a panel of experts speaking at the Jersey Finance London Funds Conference.

Q&A: Carlos Lavilla, Ascri president

Q&A: Carlos Lavilla

In defence of private equity

There is increasing noise about unjustifiable fees in an industry that fails to live up to expectations. But this belies some outstanding performances and the promise of new opportunities, finds Kimberly Romaine

IPOs "not best option" for private equity

While trade sales and secondary buyouts have been the most favoured exit route for private equity players, 2013 has seen renewed enthusiasm surrounding the public markets. Amy King reports from an ICAEW seminar on the IPO market