Analysis

The pitfalls of turnaround investing

Turnarounds are in the news once again, with the decision by specialist investor OpCapita to put struggling electricals retailer Comet into administration. Last week, Deloitte took over the administration of the business, and on Monday made over 300...

Sofinnova closes largest European life sciences fund in years

Sofinnova Partners is due to announce a final close on its seventh life sciences fund in the second week of December, unquote” has learned. Kimberly Romaine reports

Will VCs stand out from the crowd?

Crowd funding

Southern Italian VCs shaping the industry's future

Southern Italy

Listed PE yields results

The investment landscape is rapidly transforming, reshaping itself almost beyond recognition as past follies take their toll on institutional investment powerhouses and new investors arise to take their roles in this new world. But will the much maligned...

The irrelevance of fees

Fees: irrelevant?

Special Report: Italy

Special Report: Italy

French tax reforms getting carried away

The Loi de Finances 2013 introduces a number of measures likely to impact French PE firms. Greg Gille talks to Herbert Smith Freehills’ Jérôme Le Berre (pictured) to find out what the implications are for future investments.

DACH leads quiet Europe in Q3

DACH on top

DACH fundraising

The Q3 2012 unquote” Private Equity Barometer revealed DACH leads Europe’s buyout tables by value for the three months to end September, with Germany leading the pack.

German AIFMD draft criticised for strict stance

The German government has put forward a proposal for the implementation of the AIFMD that could destroy the country’s standing as a private equity fund location. The industry is confused – is this the biggest shake-up they have seen in recent years or...

Small deals, big results

Small deals, big results

No fundraising "doom and gloom" – SJ Berwin's Sonya Pauls

Sonya Pauls on fundraising

Private equity becomes election battleground

Election battleground

The Southern European renaissance

After a bleary-eyed summer, Southern European deal activity awoke last month with a notable increase in both volume and value.

Q3 Barometer: European deal flow plummets 35%

Q3 Barometer

The unquote" forecast: Total buyouts fall by 22% in 2012

After buyouts picked up again in 2010 and 2011, this year's forecast predicts a drop in both value and volume. Anneken Tappe reports

Strong Q3 puts UK back on track

A strong third quarter showing in UK deal activity has helped put the market back on track for 2012, according to the latest unquoteт UK Watch, in association with Corbett Keeling.

LP highlights misalignment of interest with GPs

LP slams GP fees

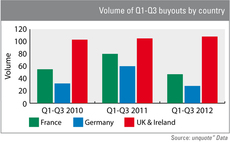

Data shows impact of continental crisis

Figures have outlined the extent to which the eurozone crisis, and other factors, have crippled the buyout market on the continent.

Oltre tackles the big issue

Social impact investing, where funds target opportunities which offer a social as well as financial return, are taking off in some parts of Europe. However, in Italy they are a rare sight. Amy King reports

DACH PE Congress: Sourcing in a low-growth environment

With the eurocrisis overshadowing any economic and fiscal concern on the continent, GPs have to rethink how to successfully source deals and impress investors to secure commitments for future funds. Anneken Tappe reports from the unquote” DACH Private...

Berlin: Europe's fastest growing tech hub

Berlin's tech hub

Cashing in on the drive for efficiency

Austerity politics can often seem at conflict with the idealised world of cleantech and renewable energy. With governments scaling back subsidies to reduce their deficits, it might seem that green investing will have slipped out of fashion. However, tough...