Analysis / Venture

Q&A: Forbion Capital Partners' Sander Slootweg

Managing partner at the life-sciences-focused VC speaks to Unquote about fundraising, pursuing a 'build' strategy and the European market

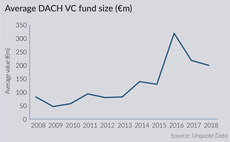

VC fundraising lifts off in DACH region

Six venture funds based in the DACH region have held final closes in 2018 for a combined €1.3bn

GP Profile: Lakestar

Unquote speaks to founder Hommels about the VC's future ambitions and the European venture landscape

GP Profile: Mangrove Capital

An early backer in Skype and Wix, Mangrove held a final close on €200m for its fifth fund earlier this year

VC fuels Europe's journey towards self-driving future

Despite the long-term nature of investing in autonomous vehicles and high barriers to entry, fund managers are finding routes into the segment

Dutch VC activity reaches all-time high

Biotech and pharma are driving record levels of VC investment in the Netherlands, while venture fundraising continues to perform strongly

Payments sector heats up across the Nordic region

PayPal's $2.2bn acquisition of VC-backed iZettle highlights the Nordic region's leading position in the payments tech market

French VC fundraising shifts towards sector specialisation

A number of specialist VC funds have held first or final closes in recent months, bringing distinct advantages and risks in equal measure

EIF's push into private capital management

The European Investment Fund is aiming to raise up to тЌ2.1bn in private capital for a new investment platform focused on venture and growth vehicles

Italian venture moves upmarket as overall activity dips

Venture dealflow and aggregate value decreased in 2017 following five years of growth, as VCs turned their attention to later-stage rounds

Nordic tech's transatlantic ambition

Nordic startups are increasingly looking to find backers with ties to the US market to support their growth strategies

Deals accelerate in German online marketplaces

Three transactions in the space within the first two months of 2018 saw PE firms invest a combined €500m and cash out more than €700m

VCs tread cautiously around blockchain craze

VC activity in cryptocurrency has increased, but despite eye-catching deals, their volume is not as high as the wider enthusiasm would suggest

ICOs and venture capital: friends or foes?

With Asgard becoming the first European VC to hold a coin offering for its new fund, ICOs might present opportunities for institutional fund managers

The lure of consumer-focused fintech

European fintech companies are attracting increasingly large investment rounds

Entrepreneurial spirit helps French VC fundraising rebound

Venture fundraising reaches 2016 levels with two months left of the year, with early-stage and expansion dealflow also on the up

Just rewards: Crowdfunding for German VC-backed startups

Rewards-based crowdfunding is not only more popular among VC investors, it is beneficial to startups too

Artificial intelligence offers smart opportunities for PE

Once the domain of early-stage VC investors, the AI segment is now attracting the attention of private equity buyers

French venture expected to flourish under Macron

VCs welcome the arrival of a president who is likely to encourage a more favourable investment landscape

VC backers fuel DACH's tech-driven transport boom

Venture-backed startups are capitalising on the slow progress made in the region by corporate giant Uber

Insurtech puts a premium on technology

PE and VC players turn their attention to the insurance space as fintech's next scalable disruption opportunity

Belgium aiming to boost fintech investments

New Belgian-focused fintech initiative will develop close ties with London and bridge the gap between the UK and Europe

Tech and venture lead the way in May's post-Brexit vision

UK government hopes venture and technology growth will ameliorate financial services exit

Hope hangs on VC deals as Ukrainian buyouts disappear

Positive trends in growth deals driven by interest in the software and IT sectors