Analysis/Venture

Venture, tech keep UK market afloat in H1

Buyout and exit volume dropped dramatically in the first half of 2020, while GPs are doubling down on technology-driven strategies

VC Profile: Edge Investments

As the firm begins raising its second fund, chief IR officer David Fisher discusses the current portfolio, LP sentiment and the creative economy

DACH venture capital looks for a new normal

Although dealflow in the DACH VC market has remained fairly strong, deals have shrunk in average size, and uncertainty lingers

VC Profile: Isai reaches 1st close in lockdown

Founder Jean-David Chamboredon discusses the challenges of raising a fund in lockdown, and plans to deploy capital in an uncertain environment

E-scooter startups feel brunt of lockdowns but anticipate future upside

The coronavirus lockdown in Europe has put a brake on the transport sector - should e-scooter startups and their investors be worried?

VCs welcome Future Fund, but seek added clarity

VCs dicuss the use of convertible loan notes and the need for liquidity in the venture ecosystem

VCs ramp up coronavirus mitigation efforts

Partners from Balderton, General Atlantic, Anthemis Partners, TCV and Speedinvest dicuss the crisis

VC Profile: Speedinvest

Seed investor is opening a new office in Paris as part of the expansion of its pan-European platform

German VCs call for more Covid-19 startup support

Concerns centre around the profitability criteria, as well as local banks' lack of familiarity with startups' risk profile

VC Profile: CapitalT

Co-founder Janneke Niessen talks to Unquote about the firm's fundraise and its data-driven model to analyse startup teams

Swiss and German venture peaks in Q3 2019

Aggregate value of venture deals in Germany soared to more than €2.73bn across 85 deals

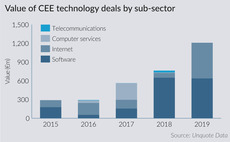

Software sector lures increasing amounts of capital in CEE

Interest in the software sector in CEE is on the up and was especially prominent in Q3

Unquote Private Equity Podcast: Nothing ventured, nothing gained

Listen to the latest episode of the Unquote Private Equity Podcast, in which the team tackles the venture capital space

CEE fund closes make headlines as dealflow slows

PE and VC activity has been rather sedate across the CEE region in October, with interim fund closes instead animating the market

Benelux biotech and pharma startups attracting larger rounds

Average tickets for early-stage investments have jumped from €13m in 2017, to €20m the year after and €36m this year

UK late-stage venture boom offsets early-stage lull

Second quarter saw an average value per deal of £30.7m, significantly higher than the 10-year average of £11.8m

French institutional LPs urged to nurture late venture

As president Macron pledges to unlock €5bn from institutional investors, Unquote looks at the current state of French late-stage venture

Kahoot inspires new wave in Norwegian edtech

Norway's VC scene may be less eye-catching than its Nordic neighbours', but the country is leading the way when it comes to education technology

All eyes on venture as corporates and PE swoop in

Up to 17% of venture investments in 2018 saw the backing of an investor based outside Europe

CEE venture ecosystem matures as buyout market stalls

With the buyout market at an inflexion point, the local venture capital scene could be the one grabbing headlines in the coming months

European VC catching up to US, says EIF's Grabenwarter

Panellists at the recent Invest Europe Investors' Forum in Geneva extolled the virtues of the European venture ecosystem

Blockchain heralds crypto's second coming

Following the launch of the first securitised token offering to retail investors in the UK, Unquote explores the potential for future VC involvement

VC activity picks up steam in Spain

Venture capital activity maintained momentum in 2018, largely fueled by international players in later-stage rounds

Unquote Private Equity Podcast: Crypto craze

Listen to the latest episode of the Unquote Private Equity Podcast, in which the team decodes the intricacies of securitised token offerings