GP Profile: August Equity Partners

Katharine Hidalgo speaks to August Equity Partners' managing partner, Philip Rattle, to discuss the firm's investment strategy for its latest fund, the steps it has taken to mitigate the effects of the coronavirus crisis on its portfolio, and its exit strategy.

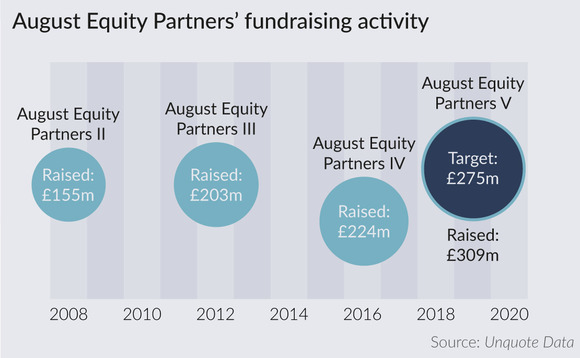

As many firms delay their fundraising processes, August Equity Partners is in the advantageous position of having closed a fund before the coronavirus-related fundraising lull permeated in Europe. The firm's fifth-generation vehicle closed on its hard-cap of £300m in February 2020.

Managing partner Philip Rattle says: "Fundraising has definitely been affected in this crisis; but even before it, it was getting tougher. LPs are looking to make fewer and larger commitments. The current situation will amplify those stress points. Having capital recently committed allows us to support our investments, it gives us stability, and the ability to focus on new investment and portfolio management rather than fundraising."

Many existing investors, including BMO Global Asset Management, Argentum, M&G and BNP Paribas Private Equity, re-upped for AEP V, but the vehicle also diversified the firm's investor base. Rattle says the fund saw around 25 LPs participate, a slight increase on the number for AEP IV. US-based investors committed $170.5m to the fundraise, more than 40% of the capital in the fund, according to an SEC filing.

In the current environment, several market commentators have speculated on the possibility of LPs defaulting on their commitments. One venture investor told Unquote that LP defaults had already occurred in some VC funds with smaller LPs. Rattle says: "We're not concerned our investors are going to default, they're all institutional blue-chip investors."

AEP V made its first investment in IT services provider Air IT upon its close in February. The fund will write equity cheques of £15-40m for companies with EBITDA of £1-5m and will look to acquire 10 companies, though it has not made a second investment yet. "There was a pause immediately following the measures imposed to stop the spread of the coronavirus in the UK, but we continue to look at sector focus areas," says Rattle. He says the firm aims to acquire three companies in the next six months.

The firm typically invests in service-led, UK-based businesses, with a focus on accreditation and certification companies, healthcare and IT services. Rattle is not expecting to change the firm's strategy or sector focus because of the coronavirus crisis: "We're looking at how these companies we may invest in have responded to the current circumstances, but as long as they still fit the characteristics we're looking for, we're still interested."

Some market participants have reported valuation discounts of up to 25-35% against valuations prior to the crisis. While this presents opportunities for new investments, it also has serious repercussions for existing portfolios. Says Rattle: "All the major public markets are showing significant falls. The businesses we're considering investing in, we've been talking to them for several years in some cases, and they have obviously been attractive to us for some time."

He added: "We haven't yet started testing if there's been changes in valuations. Terms will change undoubtedly."

All hands on deck

Rattle says the firm has taken a number of measures to insulate its existing portfolio from the risk of running out of cash. "We've looked at all of the recommendations for funding from the BVCA. We've also created a positive dialogue between our portfolio and lenders, providing a great deal of information. We haven't made any equity injections."

AEP IV closed on £224m in April 2017 and recently made its 10th acquisition, its last investment. "For AEP IV, we're putting the remaining capital in the fund behind supporting and investing in organic growth plans and acquisitions. Conversations are still continuing with businesses we plan to bolt on, so we've just done another round of allocations of the remaining capital in the fund."

Rattle says the firm is already starting to look ahead to see how its portfolio can progress in the current environment. He says: "This situation will pass. We're having a session next week with our portfolio companies to talk about growth opportunities and new initiatives."

Assets in the fund include Genesis Dental Care, accreditation firm British Assessment Bureau and computer services company Charterhouse Voice and Data.

AEP III, which closed on £200m in December 2013, is currently in its realisation phase. The fund most recently exited Wax Digital, a procurement software developer, to trade buyer Medius in November 2019. August acquired the company in an off-market transaction in November 2015.

Wax was the sixth realisation from the fund, following the disposal of Vet Partners in August 2018 to BC Partners and the sale of Compass Community in 2017 to Graphite Capital.

Rattle says: "We have no imminent exits, but we're looking at exits in the next 6-12 months. Some of our businesses, if they continue to perform well, will remain of great interest to acquirers."

Assets in the fund yet to be sold include healthcare provider The Old Deanery Care Village and UK schools operator Easton Square School Group.

Current portfolio companies

| Company | Date of initial investment | Sector | Fund |

| Eaton Square School Group/Ravenstone School | Jul 2013 | Specialised consumer services | III |

| The Old Deanery Care Village | Nov 2013 | Healthcare providers | III |

| Westpoint Veterinary Group | Jan 2014 | Specialised consumer services | III |

| Safety and Survival Systems International (3Si) | Nov 2014 | Recreational products | III |

| Pet Cremation Services | May 2015 | Specialised consumer services | III |

| Orbis Education and Care | Sep 2016 | Specialised consumer services | IV |

| Genesis Dental Care | May 2017 | Healthcare providers | IV |

| Fosters Funeral Directors | Jun 2017 | Specialised consumer services | IV |

| Zenergi | Nov 2017 | Business support services | IV |

| Genesis Dental Care/Dental Partners | Dec 2017 | Healthcare providers | IV |

| British Assessment Bureau | Jan 2018 | Business support services | IV |

| Charterhouse Voice and Data | Nov 2018 | Computer services | IV |

| Hallmarq Veterinary Imaging | Dec 2018 | Medical equipment | IV |

| Code | Nov 2019 | Software | IV |

| Air IT | Feb 2020 | Computer services | V |

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds