UK fundraising update: pausing for breath

A number of Ireland- and UK-based GPs that closed their most recent funds more than three years ago have delayed fundraises to either later in 2020 or 2021, or have altogether decided to explore new options. By Katharine Hidalgo

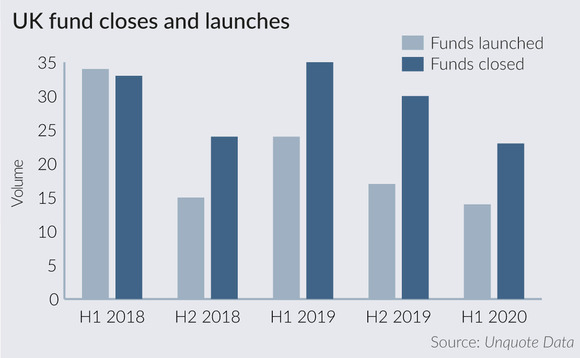

While a decent number of funds in the UK have pushed towards final and first closes in the midst of the coronavirus crisis, other GPs that held final closes between 2013 to 2016, and are therefore likely to be heavily deployed and nearing a new fundraise, are more reticent.

How quickly the economy rebounds in the wake of the first coronavirus wave will have a bearing on market sentiment, but, for now, several GPs have expressed a desire to focus on their portfolios and push fundraising further down the line. Many such firms have decided to delay funds planned for 2020 to 2021, while others have altogether shelved plans to raise a new fund for the time being, instead in some cases resorting to requesting extensions to existing funds.

This aligns with findings from a recent LP survey from placement agent Cebile Capital, which found that 80% of respondents have seen fund delays. It also concluded that 40% of LPs would find it helpful if GPs delayed fundraisings.

Lonsdale Capital Partners is expected to recommence fundraising for its second-generation fund in the second half of 2020. Unquote understands the firm plans to hold a first close towards the end of the year. The firm closed its debut fund on £110m in April 2016; the vehicle is now 80% deployed and is looking to deploy further capital in the short-term, actively seeking new deals.

In the large-cap segment, Charterhouse initially expected to launch its next vehicle in June 2020; the process is understood to be likely to occur following the release of Q3 results. Charterhouse XI will have a target of €2.5bn. Charterhouse X held a final close in November 2016 on €2.3bn, below its target of €3bn. It was 68% deployed as of November 2019.

Despite challenging conditions for consumer companies, Piper Private Equity is now expected to launch its seventh-generation fund in 2021, managing partner Chris Curry told Unquote. The fund is expected to target £150-175m. The consumer-focused firm is currently deploying Piper Private Equity VI, which closed on £125m in October 2016. The firm owns stakes in restaurants and bars such as Turtle Bay, Loungers and Flat Iron.

Buyout and growth capital investor Panoramic Growth Equity closed its latest fund on £65m in May 2016 and is currently 60% deployed. Managing partner Stephen Campbell told Unquote that the firm initially intended to launch the fund at the end of 2020, but now wants to focus on deploying the predecessor fund. Panoramic Growth Fund III is expected to target around £80m.

Dublin-based Causeway Capital Partners closed its debut fund in April 2016 on €50.5m, which is now 80% deployed. The firm, which was made famous by its acquisition of troubled cafe chain Pattiserie Valerie in February 2019, is currently focused on its existing portfolio, rather than fundraising, a source close to the situation told Unquote.

Back for more

Lower-mid-market firm RJD Partners is not looking to raise another fund currently, according to a source familiar with the situation. The firm closed its third-generation fund on £50.5m in April 2015. Soon after the lockdown was put in place following the coronavirus crisis, the firm requested an extension to RJD Private Equity Fund III, which LPs granted. The firm is now actively looking to invest from the existing fund, and most recently acquired Improve International for £12.75m in June 2020.

Industrials-focused firm Elaghmore has taken similar steps in lieu of raising a new fund. The firm is currently raising for an extension to its debut fund, which initially held a final close on £60m in December 2016. The firm expects to close this fundraising towards the end of Q3 2020.

Several other lower-mid-market firms should have been good candidates for a fresh fundraise in the not-so-distant future, having held fund closes between 2013-2016 and deployed at pace, though it is unclear at this stage how the crisis will influence the timing of a potential return to market.

Among these are Key Capital Partners, which closed its most recent fund on £65m in November 2016. The fund was 80% deployed as of February 2020, according to Unquote Data. Other firms that should be nearing a new fundraising cycle include PHD Equity Partners, which most recently closed its No 2 fund on £20m in May 2015. Rutland Partners also closed its most recent fund in January 2015 on £263m.

Causeway Capital Partners, Charterhouse, RJD Partners, Elaghmore and Lonsdale Capital Partners declined to comment, while Key Capital Partners, PHD Equity Partners and Rutland Partners could not be reached for comment.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds