Charterhouse Capital Partners

Charterhouse transfers Sagemcom to AlpInvest-backed continuation fund - filings

GP will make a return of over 5x MOIC on the deal for French telecoms business

Charterhouse exits Tarsus to Informa for GBP 790m EV

Sale of Dublin-based B2B events group marks seventh exit from the sponsorтs tenth fund

Charterhouse expected to launch Optima's sale by early 2023

Owner is yet to appoint advisors to guide it on exit of Italian food ingredients producer

August reaps 8x money on Amtivo exit to Charterhouse

GP will reinvest in accredited certification group as minority shareholder alongside management

Charterhouse reaps 4x in SLR Consulting sale to Ares Management

UK environmental advisory group to receive investment from Ares' private equity fund to support growth amid trends towards sustainability

Phoenix sells 1000Heads to PE-backed Labelium

Phoenix Equity Partners has sold its stake in UK-based social media data and consultancy firm 1000Heads to France-headquartered Labelium, a portfolio company of Charterhouse Capital Partners.

Motion readies Minlay for sale advised by Natixis Partners

Apax, Charterhouse and IK are eyeing the French dental prosthetic devices company

Charterhouse to exit Siaci Saint Honoré to OTPP et al.

OTPP, Cathay, BPI France and Ardian back the deal and SSH's merger with market peer Diot

Charterhouse buys Labelium from Qualium

B2B digital marketing agency made six add-ons during Qualium's three-year investment period

DBAG sells Telio to Charterhouse

DBAG will reinvest in the prison communications system provider to hold a 13% stake

CVC buys Cooper from Charterhouse for €2.2bn

CVC invests via fund VII, while Charterhouse will reinvest in the OTC pharmaceuticals business

Latour to acquire 33% stake in Charterhouse's Funecap – report

GP reportedly placed the funeral service provider up for sale in 2020, advised by DC Advisory

Charterhouse invests in Phastar

Phastar operates across an international network of 12 offices and employs 250 people

Inflexion sells LCP to Charterhouse for £300m

LCP's executives and employees own a majority of its shares and its partners will increase their share

Charterhouse buys Novetude Santé

GP intends to boost the company's growth, bolster its international expansion and pursue a buy-and-build strategy

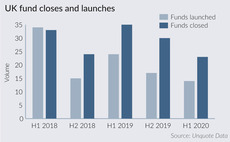

UK fundraising update: pausing for breath

A number of GPs that closed more than three years ago have delayed fresh fundraises, or have altogether decided to explore new options

Buy-and-building through the storm

Bolt-ons remain one way of deploying capital and building value, but a tough financing market and pricing mismatches make for a challenging landscape

UK fundraising update: name-brands push on through

Despite the coronavirus crisis, many GPs and VC investors are expecting to hold closes in 2020

Charterhouse's Serb bolts on UK-based Veriton Pharma

Belgium-based pharmaceutical company has made five bolt-ons during Charterhouse's investment period

Charterhouse-backed Tarsus acquires Unfiltered Experience

GP's tenth fund acquired Tarsus in 2019 in a deal that valued its equity at ТЃ552m

Charterhouse's Optima acquires Blend Coberturas

Deal follows Optima's acquisitions of Modecor, Giuso Guido and Pernigotti's ice cream division

EQT Credit moves in to take over Charterhouse's Bartec

EQT Credit II and EQT Credit Opportunities III have notified the Austrian regulator

Charterhouse-backed Siaci Saint Honore buys Cambiaso Risso

Combined group will operate in five new countries while strengthening its position in several ports

Charterhouse-backed Cooper bolts on Diepharmex

Geneva-headquartered Diepharmex manufactures products for hygiene and ear care such as ear sprays