Value of UK early-stage investments holds steady

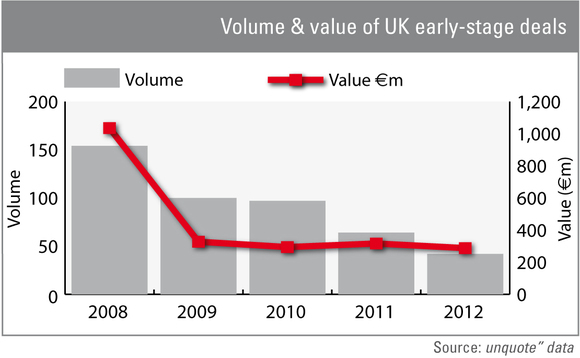

UK early-stage deal numbers are dropping off, but the total value invested has held steady over the last four years.

The UK's relationship with early-stage deals has been understandably tense since the dotcom crash in 2000. However, by 2008, the total value of early-stage investments had crept back up to levels not seen since 2001, reaching €1.03bn. The financial downturn then put the brakes on the recovery of the UK's start-up arena, as it did across all markets. But, from 2009 to 2012, despite falling deal numbers, according to unquote" data the total amount of cash invested in the space has hovered around the €300m level each year throughout that period.

It is encouraging to see some stability in the early-stage market, especially as start-ups have been heralded as a major part of the solution to the UK's sluggish economy.

Alex Macpherson, head of the ventures team at Octopus Investments, explains: "Last year we saw some larger transactions, which is a positive for the market. Today we are seeing a vibrant early-stage market, but ironically there is a lack of early-stage investors. So for those with funds, there are significant opportunities for investment."

UK start-ups are positive about the coming year, according to a recent survey completed by Silicon Valley Bank (SVB): 66% of respondents reported improved business conditions in 2012 compared with 2011, while 73% reported they met or exceeded revenue targets last year.

Following the ups and downs suffered by the UK early-stage investment market, government initiatives such as Tech City and progressive events including the Silicon Milkroundabout – a recruitment fair exclusively for start-ups – have ignited a frenzy of media attention and, more importantly, have turned start-ups into feasible career paths.

But despite the growing significance and need for young and innovative companies, the fundraising environment is dismal. According to SVB's findings, 39% of those surveyed are looking to raise capital from venture or angel investors. However, 90% of respondents said that fundraising is challenging or extremely challenging. Says SVB vice president Bindi Karie: "Many executives have concerns around how they should fuel the next level of growth, since access to funding and talent are cited as challenges for many start-ups. Nevertheless, these are exciting times for the UK tech scene."

Lack of government support has been cited as a key issue hampering growth of the early-stage industry. Start-ups are calling for increased access to government grants and funds, improved communications infrastructure, a more flexible regulatory environment, easier access to employment visas and tax reform – such as the R&D tax credit allowance.

With or without further government support, the UK now offers a wealth of innovative start-ups hungry for investment. Furthermore, the sector is attracting more human capital, making development of early-stage companies more viable than it would have been following the dotcom crash or in the years immediately after the financial downturn. Early-stage investors are clearly positive on what this market can offer, though the trend witnessed over the last five years must be addressed.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds