BGF on track for busiest ever year

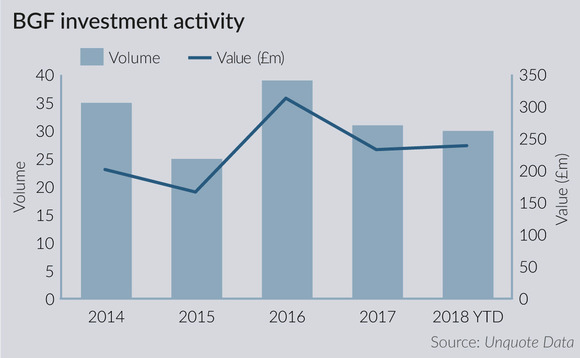

With 30 deals already inked so far in 2018, UK investor BGF is on track to comfortably beat its previous record deployment year, according to Unquote Data.

The investor has been deploying at pace in recent weeks, with eight investments already recorded by Unquote for Q3 so far. Recent deals include the injection of a further £10m in UK holiday park operator Coppergreen Developments, as well as a £11.5m investment in behavioural marketing firm SaleCycle.

Should it continue deploying on this trajectory, BGF could see its Q3 tally exceeding the already strong first quarters and second quarters of the year, with 13 and nine deals respectively.

Overall, BGF has already inked 30 deals so far this year, for an estimated aggregate value of around £239m. The amount deployed has already matched the full-year figure for 2017 (c£232m) while the deal volume is just a transaction shy of the 2017 total (31 transactions).

With slightly more than four months to go, 2018 is virtually guaranteed to be BGF's busiest year ever. The previous record was set in 2016, when the investor deployed around £313m across 39 deals. By this point in the year in 2016, BGF had completed 24 deals.

That year also marked the point at which BGF started deploying larger tickets on average, a trend that is continuing this year. Investing off its own balance sheet, BGF states that its initial investments are typically between £1-10m. In practice, most deals in recent years have been at the upper end of that range. According to Unquote Data, 2018 deals have averaged around £7.9m apiece, slightly up on 2017's £7.6m but not quite on par with the 2016 average of £8.6m.

Overall, BGF deployed an estimated average of £5.8m per deal between inception in 2011 and 2015. That average has crept up to around £7m since 2016.

Given its substantial firepower (a £2.5bn balance sheet as well as €250m earmarked for Irish SMEs), BGF is unsurprisingly a cornerstone of the UK's growth capital and venture space. According to Unquote Data, BGF has been the busiest investor in the country by some margin over the past three years, outpacing its nearest competitor by a nearly three-to-one margin.

Click here to view a full profile (including sector breakdowns and a comprehensive deal list) on Unquote Data

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds