In Profile: Synova Capital

As Synova Capital prepares for its 10th anniversary next year, Denise Ko Genovese catches up with Philip Shapiro after the GP closed its third fund in record time

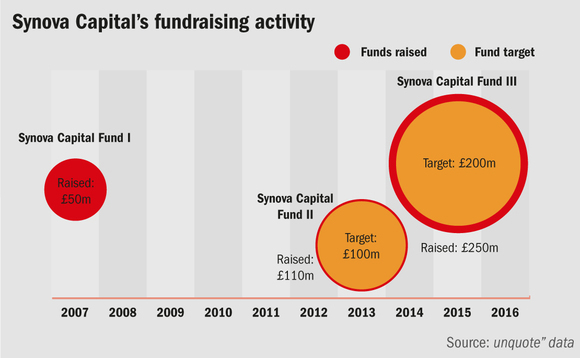

"We started in 2007 so next year will be our 10th anniversary," says Philip Shapiro, managing partner of Synova Capital, which earlier this year closed its third fund on £250m in a record three months.

"We started fundraising in late October and had allocated the fund by Christmas, but didn't close the fund until January to allow some LPs to use their 2016 allocations," says Shapiro. "We were significantly oversubscribed and could have raised the hard-cap given the appetite, but we wanted to retain our focus on the lower-mid-market."

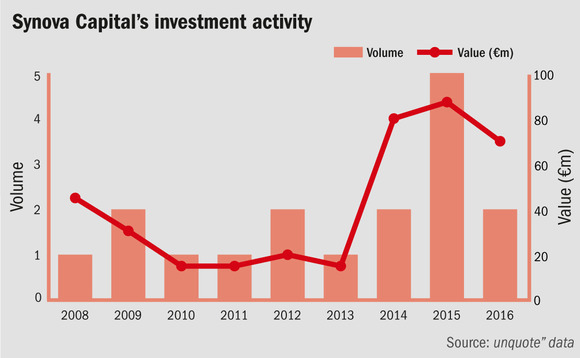

And the GP has not wasted any time deploying capital from its third fund with independent financial advisory firm Fairstone acquired in April and private resident care service Oakland Primecare acquired in July.

Synova has three funds in total. Synova Capital Fund closed on £50m in 2007 and is 100% deployed and committed, and on track to make 4x money once the two remaining investments are realised in the next 18 months. Synova II closed on £110m in 2013 with institutional investors only and is fully committed. It exceeded its original £100m target and has eight investments. Apart from MK and Stackhouse Poland, which were acquired in 2014, the remaining six investments were made in 2015 (Defaqto, Ways Healthcare, Fleetway Travel, Merit Software, Vistair and Clyde Munroe). Most recently, the GP raised the aforementioned Synova III, closing on £250m in January 2016.

"Although we are probably a few years off fundraising again – since you don't typically go out until you are 75% invested – the fundraising door never really closes," Shapiro says. "The meetings continue as you can't really just turn up at someone's door and demand money and a commitment out of the blue when the time comes."

Almost all the LPs in Fund II also backed Fund III, alongside a few new names – notably from the US and Asia. Incidentally there are no UK-based LPs in Synova's most recent fund.

Stellar exit

Of the 15 investments made since the GP set up shop in 2007, it is easy to see why the 16x exit multiple for regulatory and compliance business Kinapse is a clear highlight.

Kinapse provides consultancy services to the life sciences industry, with a focus on regulatory compliance and quality. Synova acquired the business in 2012 and in under four years grew EBITDA from less than £1m to £8m, against revenues of £6m and £28m respectively.

"A total of 10% of all pharma spend is on regulatory and compliance issues so, given that the industry is multi-billion dollar in size, 10% is still a lot of money," says Shapiro. "By the end, 19 of the top 20 pharmaceutical companies were clients."

Fund I, from which the Kinapse investment was made, boasts six investments and three exits already. Synova acquired dental supply services group DBG in 2010 and grew the business to £3m EBITDA from £1m, making an almost 6x return on exit in 2013. Luxury brand group TLG also came from Fund I and generated a 3x return on exit in March 2016, after almost eight years with Synova at the helm. During the GP's tenure, revenues grew to £30m from £13m and profits almost tripled.

Brexit-proof

"We actually closed our fundraising before investors started asking whether Brexit would have an impact," says Shapiro, referring to Fund III closing in January this year. "So we didn't have to answer the questions but people fundraising now of course have to face them."

"We stress test all our companies against a recession scenario and we stay away from investments that could be impacted," he says, adding that Synova's investment in Oakland, which operates private elderly care homes, is an example of a recession-resilient sector. "Of course there has been sterling devaluation post-Brexit but we don't have businesses with dollar/euro input prices that would be directly affected."

Strategy

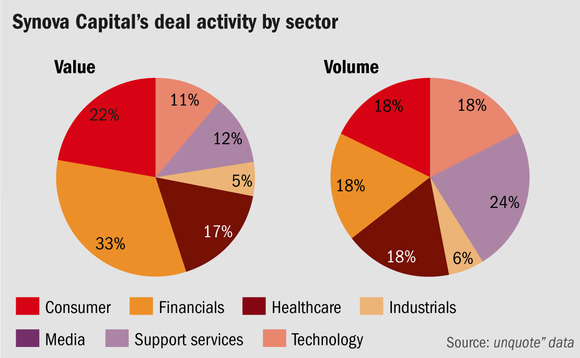

Shapiro set up the UK- and Ireland-focused private equity house in 2007 after a stint at Phoenix Equity Partners. The strategy remains the same in targeting manager-owned businesses where the GP can drive accelerated growth. "It was an under-served part of the market back then and continues to be so," he says.

Synova does not target buy-and-build strategies as it looks for companies with enough fundamental growth. However, Shapiro admits some companies and sectors, such as dentistry and the independent financial advisory (IFA) market, lend themselves naturally to add-on growth strategies. Scottish dental business Clyde Munroe and IFA business Fairstone are cases in point. "They lend themselves to buy-and-build. You are not going to get 25% organic growth from dental practices," he says.

Synova has already put its acquisition plan for Clyde Munroe into action, despite only having bought the dental practice in November 2015, upping the number of practices to 12 from an original eight. The Scottish market has an estimated 1,000 practices in total and is therefore ripe for consolidation.

The IFA market is similar to dentistry in its fragmented nature with an estimated 11,000 IFA providers. "If you are an IFA, and you join the Fairstone platform, it is a good way for you to grow your business [with Fairstone's help], but also get an exit plan in place for a few years' time," says Shapiro. "The average age of an IFA in the UK is 57, so it is an attractive model, as many are looking to retire soon."

Indeed there are currently around 40 IFAs signed up and with the help of Synova – which committed £25m from its third fund in April 2016 – Fairstone now has the cash to buy them.

Key People

David Menton is a managing partner and, prior to co-founding Synova in 2007, spent a number of years at a subsidiary of WPP and a family office investment firm.

Philip Shapiro is a managing partner. He previously worked at Phoenix Equity Partners, before co-founding Synova.

Alex Bowden is a partner and joined the firm in 2011. Prior to this he worked at LDC and 3i.

Tim Ashlin is a partner and joined the firm in 2014 after a stint at Phoenix Equity Partners.

Daniel Parker is CFO and partner and was previously at private equity and infrastructure fund manager Zouk Capital.

unquote" is currently mapping out the European mid-market with a growing selection of in-depth, data-driven profiles of the major players in that space. Recent articles include Livingbridge, August Equity and Dunedin, with Silverfleet and Northedge coming soon.

These profiles are a must-read for GPs wishing to benchmark themselves against their competitors, for LPs mapping out the European private equity landscape, and for advisers on the lookout for an edge when pitching to potential clients.

Make sure to bookmark this page as we will keep adding to this list of exclusive profiles in the coming weeks.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds