GP Profile: Inflexion Private Equity

Following a handful of fundraises in a short period of time, unquote" speaks to Inflexion Private Equity about a busy 2016 and the GP's trajectory

The year started well for Inflexion Private Equity with a double fundraise completed in May – £250m for Inflexion Enterprise Fund IV and £250m for Inflexion Supplemental Fund IV. Both were raised from existing LPs within eight weeks of launch, without the help of a placement agent. This marked the firm's second double fundraise, after it closed both a buyout fund on £650m and a minority-focused partnership fund on £400m in October 2014.

"We managed to complete the [2016] double fundraise quickly since we had only been out to the LPs for the buyout fund a year before and the diligence was pretty up to date," says Inflexion managing partner Simon Turner. "Most of our LPs have invested in all our funds and know us well."

Inflexion Enterprise Fund IV focuses on the UK lower-mid-market and continues to use its predecessor funds' strategies, investing equity of between £10-20m for both majority and minority stakes. The vehicle will invest across all sectors throughout the UK. Raising another generation of the lower-mid-cap vehicle will allow Inflexion to keep investing in that space while Buyout Fund IV addresses opportunities higher up the value chain – the latter fund provides equity tickets in the £15-75m range.

Inflexion Supplemental Fund IV enables the GP to co-invest alongside the larger buyout and partnership funds raised in 2014 – Inflexion Buyout Fund IV, a £650m fund, as well as Inflexion Partnership Capital Fund I, a £400m vehicle.

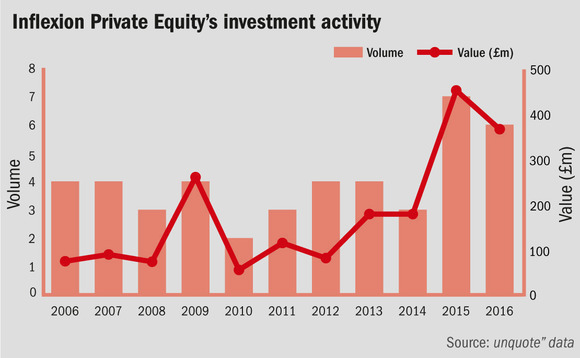

Unsurprisingly, the double fundraise in 2014 coincided with a marked uptick in deal-making for Inflexion. While the GP used to complete three to four deals a year on average in the post-2009 period, it inked seven deals in 2015 and has so far scored six transactions in 2016.

Indeed, Inflexion has been a mainstay of the UK lower-mid-market private equity scene over the past 24 months. According to unquote" data, the GP was the second most active house in the £25-250m segment over the period, second only to the traditionally active LDC.

Minority buyout boost

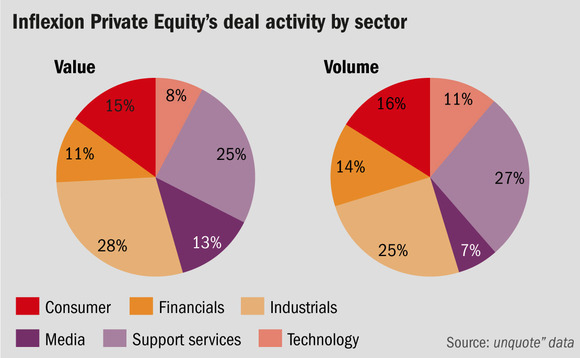

Drilling down into unquote" data, Inflexion has been a prolific investor in the industrial sector, closely followed by consumer services. The GP predominantly invests in the UK, with only a very small slice of money going into Germany-headquartered companies.

There was a notable increase in minority buyouts after the GP raised its £400m Partnership Capital I fund in 2014 with the specific purpose of acquiring minority stakes in the mid-market, such as software company Mobica in September 2015 and media agency CloserStill in March 2015.

"There are lots of firms doing control buyouts but we have had a lot of success doing minority investment deals over the past decade and feel we have quite a unique offering and understand how the rights and controls differ," says Turner. "The LPs also liked the idea of having a separate fund [for this] so they knew what they were getting."

Activity over the last 12 months includes a minority investment in UK provider of digital advertising billboards Outdoor Plus in November; a majority stake in UK-based video advertising business Group IMD via a secondary buyout from Vitruvian Partners in September; support for the management buyout of corporate, fund and fiduciary administration business Bedell Trust in September; the acquisition of corporate travel business Reed & Mackay from ECI Partners and Livingbridge in August; and the MBO of forex hedging business Global Reach Partners in March.

The uptick in activity over the past 12 months also extended to Inflexion's divestment pace. In 2016, the GP sold its stake in premium fashion retailer Jack Wills to BlueGem Capital Partners in October; risk and compliance software company CMO Software to TA-backed US trade buyer Mitratech in June; and energy-saving devices producer CP Electronics to French corporate Legrand in May 2016, reaping 7x money.

The firm also took advantage of a window of opportunity in the public markets two years ago to float two portfolio companies with solid results: FDM, which reaped 16x, and National Accident Helpline, which made 3.7x, were both listed in 2014.

• John Hartz, managing partner, co-founded Inflexion in 1999. He jointly chairs the investment committee and sits on the board of Shimtech.

• Simon Turner, managing partner, also co-founded Inflexion in 1999. He is joint-chair of the investment committee and sits on the board of Scott Dunn.

• David Whileman joined Inflexion in 2013 as a partner and is a member of the investment committee. He leads the Partnership Capital team, which specialises in investing in companies for a minority stake.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds