In Profile: TDR Capital

TDR Capital has registered its fourth buyout fund, following the successful launch of its annex fund earlier this year. Denise Ko Genovese reports

Mid-market private equity group TDR Capital is to embark on the fundraising trail again, registering TDR Capital IV in August this year.

Most known for its take private of Pizza Express in 2002, the GP has raised three funds since inception in 2002 when it was founded by Manjit Dale and Stephen Robertson with the backing of Tudor Group.

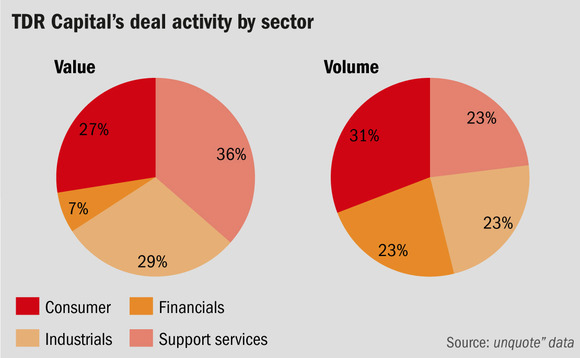

The GP was most active between 2014 and 2015, for exits and investments respectively, with the transactions revealing the UK as its dominant region and most of its activity coming in support services and the consumer sector.

TDR has had a quiet 2016 but the GP was in the news with a notable fund restructuring earlier in the year. It also saw its portfolio company, petrol station forecourt retail operator Euro Garages, bolt on Netherlands-based European Forecourt Retail Group in October.

In February 2016, the GP launched an annex fund to inject fresh cash into the remaining companies in TDR II. It raised €835m for this, according to a market source. The two companies in need of further investment were believed to have been British pub group Stonegate and life insurance provider Retirement Advantage.

Fundraising and investments

There have been three funds to date; TDR Capital I was announced in March 2002 and made a final close in April 2004 raising €550m and achieving a gross multiple of roughly 2.7x and a gross IRR of about 68%.

TDR Capital II was announced in March 2006 and made a final close in July 2006, raising a total of €2.2bn in commitments, while TDR Capital III made a final close in April 2014 and raised €2.1bn.

There are currently 10 investments in TDR's portfolio – Leaseplan, Hurtigruten, Keepmoat, EFR Group, IMO Car Wash Group, David Lloyds Leisure, Retirement Advantage, Stonegate Pub Company, MCS Group and Algeco Scotsman. TDR has completed five exits – Lowell Group, VPS Holdings, Phoenix Group, LPR and Pizza Express.

Key People

• Manjit Dale, partner, founded TDR in 2002 after working at DB Capital Partners and its predecessor firm BT Capital Partners.

• Stephen Robertson, partner, co-founded TDR in 2002 after working at DB Capital Partners, Merrill Lynch and Bankers Trust.

• Other partners include Brian Magnus, Eleanor Chambers, Stephen Robertson, Blair Thompson, Thibaut Large and Mark Budd.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds