PE's balancing act: LP appetite remains strong despite challenges

In the second part of our Q&A session looking back on 2016 and assessing the outlook for the next 12 months, leading private equity practitioners from various corners of the market discuss co-investment, fundraising and Brexit

Gregoire Gille: Co-investments were much discussed this year – what are your views on the way they impact processes and the GP/LP relationship?

David Wardrop (Rutland Partners): Two of our deals have had co-investment. For certain things, for example where the equity cheque is just beyond what we would be comfortable having as a fund, co-investment is a boon.

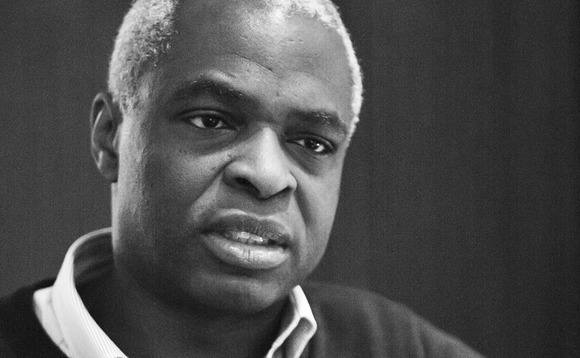

Wol Kolade (Livingbridge): I have a philosophical problem with this. Yes, there are balance sheet reasons for doing it, but they are rare. The way I look at it is, people who ask about co-investment want a discount on my fund. I say, no. You want in? Pay the right price, we'll do deals. It's a major distraction. We've done two, but I just don't like doing them.

Simon Cope-Thompson (Livingstone Partners): Where it can be quite interesting is when you have an investor who comes from an industry and can be actively involved with a particular business – that can be quite attractive to a vendor or management team. But that's quite rare.

Janet Brooks (Monument Group): It is a rare situation. It is just capital and I think the conflicts that come into it are so huge. You have LPs saying they don't want to invest in a fund where everybody else is desperately keen to co-invest, because they know it's going to force a GP to go for larger deals and it's going to mean that these investors are differently motivated to themselves.

Kolade: The advisory board conversation becomes different because half the people around the table have got some, half haven't. You try talking about an asset that half the people are invested in and the other half aren't. How does that work? The level of complexity is crazy.

Short-term fundraising trends

Gille: What other fundraising trends do you see emerging over the next few weeks and months in Europe?

John Hess (Pavilion Alternatives Group): A number of our clients, particularly from the US, drew back so much from Europe during the financial crisis that they now find themselves under-committed to Europe, so they're actually increasing their allocations. But we still think 2017 will be a lighter fundraising year – in general we expect there'll be far fewer mid-market, small-market or country-specific funds in 2017 than we've had in 2016.

Beyond that, I don't think we'll see anything incredibly revolutionary. The one area that continues to be hot and hopefully will cool down a little next year is private credit funds in Europe. There are too many of them already – even though there clearly is a justification for them – so hopefully there are not going to be a whole lot of new ones coming to market.

Brooks: I still think it's going to be an active mid-market, we have seen so many new funds setting up and a number of groups that have diversified their strategy and have raised in different geographies or different parts of the market. We will continue to see that while the fundraising market is buoyant. It will continue to be buoyant because investors are still getting fantastic amounts of cash back and private equity outperformance is predicted to continue.

Kolade: On that US theme; looking at the LP base for our latest fund, US investors are slightly more than half the fund. That was from about 20% for the previous vehicle and, actually, we held that back quite a lot.

Brooks: We're still seeing that across most fundraisings in the mid-market area. US investors had previously done pan-European big vehicles for the most part. It makes sense for them to come down, because they can see the returns are there, they understand the market enough to do that. GPs can overlook this – everybody talks about the opportunity for Asian capital. But for a lot of the Asian investors, unless you're going to spend a lot of time visiting those markets, it's a long-term gain and you won't be getting anything for this fund because they're still not at the level. That is coming, though.

Opportunity or threat?

Gille: Looking at the impact of Brexit on European fund managers, where would you put the needle between threat and opportunity in terms of who is likely to raise?

Brooks: We were certainly very cautious about UK-specific managers in the lead-up to the referendum and there certainly was a cooling period, but we've seen some very successful raises and we're continuing to see those. Maybe it's coming back to the fact that if investors can see managers that they believe can be nimble, diligent, disciplined and also opportunistic in this environment, those are investments they're prepared to go ahead with.

We've certainly seen capital coming into the market, for US investors in particular. I don't know how they would look at the currency factor over the coming 10-year life of the fund. But I think people are seeing opportunities for lower pricing.

Kolade: We were close to allocating to people on 23 June, but 24 June was a difficult day in that we didn't know what was going to happen, and on the Monday I got a call from a very large US pension fund in the evening asking if people were dropping out, and if so, could they take the share. And nobody dropped out. But people went from thinking it wouldn't happen to what we were going to do about it once it hit. Well, we carry on.

The Brexit question isn't a question for now. It's a question for the back end of next year, beginning of 2018. That's when you've got to start thinking very hard about it.

Brooks: But we still have a lot of investors who are seeing this more as an opportunity and actually are more concerned about managers with assets in the ground that could be negatively affected by it, rather than those with capital to be invested into that environment.

Wardrop: That's been the main impression so far. People are looking at their investments and what the prognosis is for them. That was the immediate question, as opposed to how it changes your investment landscape for the future.

Gille: Looking ahead, what are your key expectations for 2017 and what are the key challenges ahead?

Brooks: For me, it's making sure we avoid any sort of potential deterioration in the fundraising market. That could be because some GPs just try to push things too far in terms of what they want and the LP/GP relationship becomes more strained. It would be awful to see short-term greed replacing long-term relationships.

Ed Waldron (Taylor Wessing): On the transactional side, we are seeing exclusivity not being granted in quite a few processes and that is keeping everyone on their toes, as we can run two or three bidders on any given process. People do not want to pick one horse and see that fall over.

Cape-Thompson: Volatility and how one reacts responsibly to what will be a more volatile environment will be a key theme. I do think there's a responsibility for advisers, investors and funders to make sure that the market is invested wisely rather than in a crazy fashion. But I believe people will invest all the way through the cycle and will make really good money.

Wardrop: Uncertainty will create opportunities. People are going to be more cautious, and that's an opportunity for the investments you already have. You'll have to be on the front foot and be active to take advantage of caution elsewhere.

Kolade: One of the defenses of the next period is going to be ‘don't do everything in the same sector', because one of them is not going to be the right sector to be in. So thinking more like a quoted investor about how you play your portfolio will be quite important.

Hess: If we had a wishlist for next year, we would like to see a private equity cycle. There's always been a period where returns have come down, investors have stopped investing and better deals have come at better prices, then it goes up again. There's been no downturn this time.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds