H1 fundraising reaches second-highest level on record

Private equity fundraising in Europe continued apace in the first six months of 2017, which saw the second largest volume of capital closed on record, falling just short of the six months to July in 2016. Gareth Morgan reports

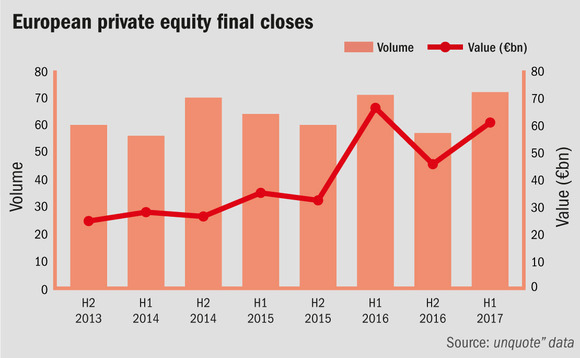

In total, 72 funds held final closes across Europe in H1 2017, according to unquote" data, raising a total of €60.9bn, up from the 57 funds closing €45.6bn in H2 2016 but shy of the €66.3bn closed in H1 2016 by 71 funds. The past three six-month periods mark a significant increase on previous brackets in terms of total capital closed, which had previously cleared €35bn just once since the global financial crisis, in H1 2013, when 60 funds secured €47.6bn.

Looking at data from the turn of the century, the relative strength of the recent fundraising climate can be seen, with 2016 and H1 2017 making up three of the strongest six six-month periods over the past 16 and a half years in terms of capital closed.

"There is a huge amount of capital in the market, and we are seeing good fundraises moving very quickly," says Janet Brooks, managing director of placement agent Monument Group. "Investor confidence is good, and there is a need to reallocate capital, which is being distributed rapidly from prior private equity investments."

The market is bifurcated, with headlines skewed towards fast, large fundraises of top-performing managers. GPs able to demonstrate consistency in returns and team development over an extended period have an advantage over their peers" - Warren Hibbert, Asante Capital

"Distributions are not quite at 2014 levels, but are coming thick and fast," says Asante Capital managing partner Warren Hibbert. "This, combined with increased allocations to alternative assets, generates a lot of pressure to redeploy capital. The market is, however, bifurcated, with headlines skewed towards fast, large fundraises of top-performing managers. GPs able to demonstrate consistency in returns and team development over an extended period have an advantage over their peers, and at the mega-cap end of the spectrum GPs are taking advantage of the cycle and insatiable LP appetite."

This redeployment of capital from existing private equity portfolios is exacerbated by shifts in LPs' wider portfolios, away from underperforming assets, particularly hedge funds, into those that generate a return, notably in the alternatives space. "We are not seeing LPs reduce their allocation," says Brooks. "LPs need yield as well as returns, and so are increasing exposure to alternatives, as well as diversifying into assets such as private debt and infrastructure."

Shifts in fund size

Breaking down the data for each quarter by fund size, the 18 months from 2016 have seen a marked drop in the percentage of venture and growth capital funds (up to €150m), which has fallen short of 30% in each of these three quarters, where it comfortably remained above 40%.

H1 2017 sees the largest percentage of funds in the core mid-market (€500m-2bn) for any six-month period since 2012, and the second largest by percentage of large-cap funds (more than €2bn). Cumulatively, these two size bands make up almost 35% of the market in H1 2017, by far the largest segment for any six-month period over the past five years.

There are several drivers of this, but LPs consolidating their private equity portfolios is a major one. "It is time-consuming for LPs to manage lots of GP relationships, and so, many are reducing the diversification of managers within their private equity portfolio," says Brooks. "There is also a push to build deeper relationships with GPs, wanting to become more important to them. This is beneficial to LPs when it comes to accessing larger allocations to the GP's next fund, and also for opening up co-investment opportunities."

There is a push to build deeper relationships with GPs, wanting to become more important to them. This is beneficial to LPs when it comes to accessing larger allocations to the GP's next fund, and also for opening up co-investment opportunities" – Janet Brooks, Monument Group

"LPs of all types have increasingly less capacity to diligence funds," says Hibbert. "Teams across the board are typically small relative to the number of funds they review (300-600 per annum). Hence, getting the right attention and resource focused on your fund offering can be a challenge. Furthermore, post the global financial crisis, LPs have determined that they do not benefit in terms of performance from the marginal diversification that a portfolio of 100+ relationships might provide and so have been reconfiguring their portfolios to focus on 25-50 relationships instead."

A big factor in the increase in allocations is the relative outperformance of private equity compared with other asset classes within LPs' broader portfolios. Hedge funds, in particular, have fallen out of favour due to underperformance recently, and, with yield difficult to find elsewhere, these assets have been shifted to private equity and other alternatives. The resilience in returns from private equity over an extended period springs, in part, from the fact GPs are able to hold assets for an extended period, and take a more hands-on approach to creating value.

A feature of the current fundraising conditions, and one that will please many private equity practitioners, is that the increased demand for high-quality managers has seen funds' terms shift in favour of GPs. "The best managers are tweaking carry and hurdle rates, but again, this is directly correlated to levels of relative out-performance achieved," says Hibbert.

There are, however, some potential pitfalls to adjusting terms that GPs should be wary of. An industry insider tells unquote" of a recent case of this causing tension between GPs and some of their long-standing LPs. "Two large managers adjusted the hurdle rates on their latest funds downwards, which was not popular among their LPs," he says. "In fact, the largest previous backer of one of the GPs did not invest in their latest fund because of the lower hurdle rate, despite the fact that if carried interest was 10% higher they would have committed to the fund without blinking."

Despite the relative challenges faced by first-time fundraisers compared to their established peers, Brooks says there has never been a better time to raise a first-time fund. "Although there is still a minority of LPs willing to back them, we are seeing an increase in first-time and spinout funds," she says. "This minority is increasing, and the volume of capital available means more of these managers are able to raise successfully." This increase is reflected in the data, with 19% of all funds closed in the first six months of 2017 raised by first-time managers, up from 16% in the previous six-month period and a five-year high.

Proceed with caution

"Many of these funds are what LPs refer to as ‘realigned capital': successful investors spunout from established, brand name private equity houses, which have set up on their own, typically to focus on the sector in the market where they would have generated strong returns in the past, but where carry potential is the driving force rather than funds under management," Hibbert says. "In our experience, the endowment community is particularly active in backing these managers as they do not have pressure to invest in a specific theme, asset class or geography and are simply looking for the best ideas globally where their mindset encourages backing new ideas over the status quo."

Despite the robust numbers for fundraising so far in 2017, GPs could face a tougher time in the near future when raising capital. This peak in fundraising and accompanying record levels of dry powder, along with a number of other factors, has driven up entry multiples for assets, creating a challenging environment for GPs looking to deploy capital. "LPs are becoming increasingly cautious; they are aware we are at the top of the market," Hibbert says.

Meanwhile, Brooks says: "LPs are wary of pricing and want to find managers who can do well at this stage of the cycle. Managers must be capable of either finding value situations in an expensive market or of creating real value in their portfolio companies despite paying large entry multiples."

With the continued strength of the private equity fundraising market over the last 18 months, and ever-increasing levels of capital in funds waiting to be deployed, time will tell if recent momentum can be continued.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds