A year to remember - and learn from

Greg Gille recaps how the European private equity industry adapted to unprecedented challenges in 2020, and gauges market sentiment when it comes to dealflow and fundraising in the year ahead

"Over the summer, LPs saw valuations start to recover and, just as importantly, we saw a return to some travel and a return to dealmaking. If you had asked back in March if it was likely to happen that quickly, people would have thought you were mad." These comments from Richard Hope, head of EMEA at Hamilton Lane, sum up how many in the industry will look back on 2020: a year in which private equity was faced with its greatest challenge since the global financial crisis (GFC), but in which it also showcased its ability to bounce back.

"The playbook in the early weeks was basically the GFC muscle memory kicking in, with everyone focused on liquidity issues," says Hope. "But in Q2, it quickly became apparent that GPs did a very good job of sitting close to their portfolios and putting in place solid three- and six-month plans to deal with the impact. Trading also snapped back very quickly at the end of Q2 for a number of assets and, in the main, it was fairly good news for most portfolios – unless they were very leisure and travel heavy, which is rare."

Echoing the views of a number of professionals Unquote has spoken to since March, Hope points out that LPs have been generally impressed with the level of transparency from GPs, compared with 2008 – and not just at the top level from the investor relations teams, but from the investment teams as well.

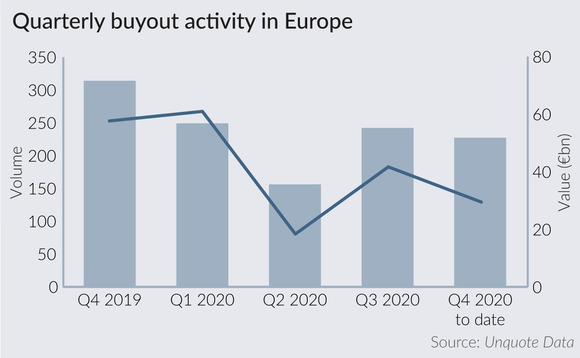

Of course, that protection and transparency effort was made possible because of (and no doubt contributed to) severely reduced investment activity from late March onward. Simply put, Unquote had not recorded such a drastic quarter-on-quarter slowdown in deal-doing since the summer of 2008.

The number of European PE-backed buyouts declined to 151 in Q2 from 241 in the previous quarter, a fall of 37%. Meanwhile, aggregate value plummeted even more sharply, to €18bn from €60.9bn in Q1, reaching its lowest figure in more than a decade, as the vast majority of processes in the mid-market and up were put on ice overnight.

Even though the volume of growth capital and venture deals remained more resilient in that first phase of the pandemic, it was clear that the boom cycle of the late 2010s had come to an abrupt halt.

But just as Unquote was starting to calculate deployment rates to figure out which funds could ill afford a year of total inactivity before over-stretching their investment periods, July saw a buyout recovery almost as dramatic as the April slump.

Buyout volume nearly doubled between June and July, while the aggregate value of these deals tripled, thanks to a raft of processes crossing the finish line in France and Italy. Although the traditionally quieter August broke that momentum – and this monthly spike has not been replicated since – it provided the first takeaway of a post-lockdown market: pent-up demand remained high on the buy-side, but primarily for high-quality assets in Covid-secure sectors. The TMT sector has been the star of that particular show: the segment has been home to 28% of all European buyouts by volume, nearly on par with industrials, compared with its 19% market share across 2018-2019.

The corollary of that flight to quality is that pricing has remained punchy, putting paid to the early expectations of a correction towards less competitive processes and, therefore, cooler valuations. According to the last two Clearwater International Multiples Heatmap reports, published in association with Unquote, average multiples for European buyouts remained firmly in excess of 10x across Q2 and Q3.

I wouldn't be surprised if 2021 ends up being a record year for average valuations – because only the best-quality dealflow will get done" – Andy Currie, Alantra

Quality, not quantity

These dynamics are likely to remain in play in the coming months, even as the market is still on shaky ground following a second wave of lockdowns.

"Overall, there is still a huge amount of capital waiting to be deployed – and with a 10-year fund life, most GPs are not likely to stop everything for 12-18 months," says Andy Currie, managing partner at Alantra. "The market is awash with cash, but it is also awash with uncertainty, so what we are seeing is a focus on resilience. Our busiest teams have been technology and healthcare; and while our consumer team has been active too, 90% of that is for businesses that are online-focused. Volume is not huge, but there are good opportunities out there."

Hamilton Lane's Hope agrees, and notes that the pace at which GPs snapped back into investment mode over the summer surprised the firm. "Liquidity constraints are likely to increase for a number of companies, and that will further play into the hands of well-funded managers," he says. "Some companies in the hardest hit sectors will be un-sellable for some time, but there is plenty to play for in other segments."

The fact that more businesses will be feeling the heat of the longer-term effects of a tumultuous 2020 could help bridge the sharp divide between ultra-resilient targets and the handful of "pure distressed" opportunities that have arisen since March. Before that happens, though, it is likely that the bifurcation that has so far propped up average valuations will continue unabated.

Says Currie: "We are also seeing lots of processes being preempted, because when people decide they want to buy, they are ready and willing to pay for that. With that flight to quality, I would not be surprised if 2021 ends up being a record year for average valuations – because only the best-quality dealflow will get done."

Hope, however, expresses some reservations around the challenges currently facing deal-doers and their advisers: "One question remains around how full the dealflow hampers will be for the coming months. Origination for the deals we have been seeing from late Q2 onwards mostly took place pre-Covid. This is what has been closing recently, but what about new processes? Now GPs have to do both investigative and confirmatory due diligence in the middle of a second wave."

"Next year will probably see similar levels of activity to the pre-lockdown period. We expect Q1 to be busy in the UK, in advance of the spring budget, which may then impact activity for the rest of the year either positively or negatively, depending on the approach taken to capital gains tax rates," Currie says.

"It also seems like a lot of the true impact of Covid has not been factored in yet," says Currie. "This is most evident when looking at public markets, where we are about 10% off pre-pandemic levels. I do not think anyone could seriously argue that across the UK, Covid-19 has only had, on average, a 10% impact on performance and, hence, values. Some businesses have increased in value as a result of a re-rating from resilience, but some businesses, especially in the hospitality and retail sectors, have had an awful time and need support."

Another key theme once deal-doing started to resume in Q3 was that PE firms would most likely be net buyers instead of sellers in the Covid-19 era. Following another period of lacklustre exit activity in Q3, even as deployment was picking up, October saw a notable spike in divestments by PE players across Europe, and November figures indicate that the momentum has not died down too drastically amid the second wave of the pandemic.

GPs announced full or partial exits from 97 investments in October alone, according to Unquote Data. This is a 56% uptick on the September figure, a 125% increase on the low point of 43 exits reached in April, and compares favourably to the 88 exits recorded on average per month between January 2018 and February 2020. Furthermore, the October 2020 figure exceeds that recorded in the same month in both 2018 and 2019.

Unquote recorded 77 exits across Europe for November, which would indicate a slight cooldown after the October glut. But this is higher than most months post March 2020, and not far off the 87 exits seen in November last year. It is also worth bearing in mind that secondary research usually continues boosting these numbers for some time after any given month ends.

It remains to be seen how new lockdowns to deal with the second wave of the pandemic, and the general uncertainty around trading prospects for a number of sectors, will be reflected in the December and January statistics. Nevertheless, Currie remains confident GPs can achieve very satisfactory outcomes for the stars in their portfolios: "If you have the right asset in your portfolio in the right niche, then valuations are pretty much at an all-time high."

There is not that much capital to go around for European managers, and most of that is quickly sucked up by the big funds" – Mounir Guen, MVision

The long and winding roadshow

Turning to fundraising, a similar story of adaptation in the face of seemingly insurmountable odds emerged, as GPs and LPs came to terms with the new reality of working in a pandemic.

"In March, we were wondering what would happen if the entire market came to a complete standstill," says Karl Adam of placement agent Monument Group. "But few LPs stepped back; there were instances of LPs waiting on the sidelines during the GFC and missing out on some great vintages, and it seems investors have been keen not to make that mistake this time."

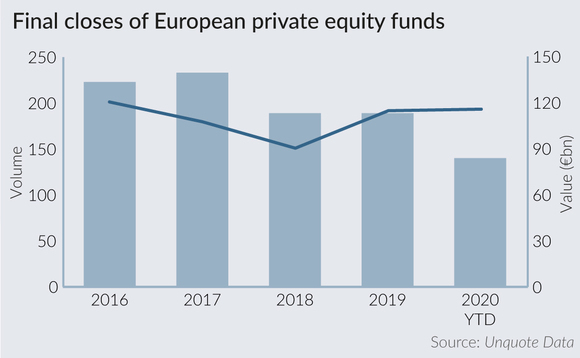

As on the deal-making front, the initial shock was sharp, with Unquote recording just 15 final closes in Europe in March and April (versus 35 on average in comparable periods between 2017 and 2019). A number of bright spots started to emerge, though, from Tenzing closing what was billed as the first "fully virtual" fundraise with its second vehicle, to CVC, Ardian and Hg pushing through to the finish line with their multi-billion-euro efforts over the summer. But scores of other funds in the market have seen timelines extended, with some GPs opting to wait out 2020 altogether before coming back to market.

But this bifurcation was not necessarily new in itself. "Investors were expecting a big correction for the past few years, so we were already seeing shifts towards three main areas: larger funds, US dollar funds, and strategies that protect principal and offer co-invest," says MVision founder Mounir Guen. "As a result, we were already seeing congestion in Europe, particularly in certain markets, such as the Nordic region, where big players will just take the capital. Covid-19 threatened to profoundly change that dynamic; and in the early weeks, many LPs thought it was the GFC all over again. It quickly became apparent that it is not, so we are back to business as usual in terms of strategies that will attract capital."

Indeed, 2020 appears to have been a decent year of fundraising by historical standards, with Unquote recording 140 final closes by European managers for total commitments of €115bn, as of early December. But 60% of that value total was raised by just eight managers, and 51% by five GPs.

Given that LPs are confident that the current crisis does not systemically threaten the attractiveness of private equity, high-profile managers should continue to do well in the coming month. As Adam says: "It tends to be very GP-specific. If you have a strong team and track record, you should not struggle."

Nevertheless, the Covid-19 crisis has thrown a number of workflow curveballs that will pose serious challenges to LPs and GPs alike. "The toughest question is how do you meet new managers or LPs," says Hamilton's Hope. "For instance, European LPs have in-person meetings as a requirement before they can commit, but they have not been able to travel to North America. This is where local pension funds may struggle to make overseas commitments without additional help, and they will potentially miss out on some good vintages."

On the GP side, it became apparent from the early stages of the pandemic that first-time managers, or even players on their second effort and with less of a track record, would risk being relegated to the bottom of the pile of PPMs sitting on the desks of overstretched LPs. Says Adam: "Even pre-Covid, it was tough for emerging managers. This year – especially without being able to meet potential cornerstone investors – it has been even harder, unless you are dealing with a slam-dunk spinout by a well-established team."

Striking a note of optimism, Adam Turtle, partner at Rede Partners, does not think that this year's events dealt a crushing blow to new blood in the industry: "It is challenging for new managers to raise at the moment, but we have received more inbound interest from potential new groups than ever, and that is because people can see that now is also a good time to set up a new group because it is a good time to start investing. You will see new initiatives being raised; and when people come to market with more differentiated offerings, you will see a further evolution of the private equity industry as a result."

New era

The placement agents with whom Unquote spoke also see a silver lining in the fundraising frenzy of the late 2010s subsiding. "GPs were anticipating the window would be closing soon, but that had been going on for a few years and it still remained open," Adam says. "As a result, some LPs were getting a bit irked by the constant stream of GPs knocking on their doors. Some will no doubt welcome a bit of a cool-down on the frenzied pace of fundraising."

The consensus is that fundraising velocity will slow down for all but the most coveted funds, but that this is not a problem in and of itself for PE – with the fixation on quick raises pre-pandemic being the anomaly in the longer term. "We were in a market pre-Covid where if you did not have a first and final closing you had almost failed, which is not normal," says Turtle. "That was an unusual market environment, and we are now back in a market where fundraisings will have a more traditional cadence, where you will have first closings and then a final closing six months later."

"The big guys all have large IR teams that are in constant fundraising mode, even when they have just closed," says Guen. "Everyone else will take two years, and there is nothing wrong with that: they should not look at the watch, but always focus on the number they need to get to."

In a similar vein, market participants are keen to stress that the industry can harness to its advantage some of the workflow changes induced by the pandemic. "There will be a long-term impact on working habits as a result of Covid-19, which has accelerated an understanding within organisations about how flexible they can be and, on an individual level, how productive one can be in different locations," says 3i's Rupert Howard.

Monument's Adam also notes that the new normal of virtual fundraising roadshows can bring in benefits, which could become permanent fixtures: "Fundraising is fundamentally inefficient, and, on average, only a handful of meetings will ultimately have a positive outcome. This is a lot of time wasted in travel and meetings, which could be used more effectively to spend time with the cohort of genuinely interested LPs. And we are also seeing LPs being more pragmatic and starting to rethink their in-person meeting requirements."

"To some extent, fundraising had already become much more data- and due-diligence-driven before the pandemic, even if a number of investors still have face-to-face interactions embedded in their protocols," says Guen. "The flip-side is that LPs now have more free time because they have fewer meetings. In a sense, we are moving back a bit from the purely transactional approach, and can develop more personal interactions through video calls."

Overall, recent months have shown that the unprecedented shock of the coronavirus pandemic did not drastically alter the market dynamics of private equity, but rather turbocharged trends that had already been on the cards for some time at the tail-end of a boom cycle. However, the coping mechanisms developed to monitor and protect portfolios, identify and transact the right deals, and maintain efficient relationships with existing and prospective investors will no doubt serve the industry well in a very uncertain future.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds