Spotlight on Spacs: Green power

The confluence of two of Wall Street’s most talked-about acronyms – Spacs and ESG – has lit a fire under Europe's burgeoning blank-cheque vehicle market, writes Ryan Gould

A surge in demand from institutional investors looking to redirect cash towards targets with robust environmental, social and governance (ESG) credentials could not be more timely for the evolution of a liquidity route that promises to pair pace with performance. Yes, the prospect of investing in a blank-cheque IPO without insight into the acquisition profile does seem to be at odds with the G in ESG, but finding solutions to a climate crisis may require a certain nimbleness too.

Sponsors recognise that the odds, for the most part, are in their favour. Bringing a new sustainability-focused Spac to market, advisers say, is befitting of a wider environment that now puts ESG front and centre when it comes to equity stories – Spac IPO or otherwise. "ESG isn't exclusive to ESG mandates," one senior London-based banker said. "ESG in ECM more broadly has moved from being a 'nice to have' to being absolutely essential."

Those already wearing the ESG Spac badge in Europe are so far united by one common theme: energy transition.

ESG Core Investments set the stage for the continent's relationship between Spacs and ESG when it became the first sustainability-focused blank-cheque company to list in Europe in February. Sponsored by Infestos, a green-focused investment firm that manages the assets of Dutch businessman Bernard ten Doeschot, the Spac raised €250m in Amsterdam to make a deal in the energy transition space. Since then, three other blank-cheque vehicles – Aligro Planet Acquisition Co, Transition, and Climate Transition Capital Acquisition 1 – have raised a combined €478m through European listings, each seeking acquisitions with an energy transition focus.

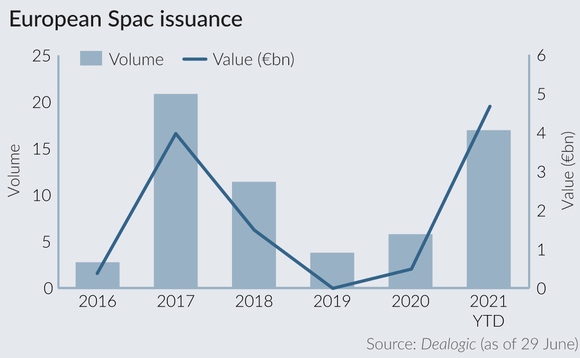

The marriage of Spacs with sustainable energy is largely reflective of what both sponsors and investors see as the result of being able to offset the high-capital, high-competition nature of such projects with the high-efficiency, relatively low risk of blank-cheque funding. The fact that energy transition-focused vehicles account for four of the 19 Spacs listed in Europe so far this year – already a new record for the continent – is telling of a confidence among sponsors that Spacs of this ilk can and will continue to attract earmarked ESG money. Do not be surprised to see more follow suit.

But while European blank-cheque issuance is expected to remain strong into Q3, advisers still maintain that Spacs are no easy sell, however luminous the "ESG here" sign. More than ever, Spac IPO investors are "screening for structure", one banker working on such listings said. "ESG or otherwise, Spacs need bright sponsors and appealing [promote] structures," he added.

For buyers and sellers, these are new times. With an expanded investor universe flush with cash, green may well prove to be gold for Europe's blank-cheque future.

'Spotlight on Spacs' is a weekly column that tracks the latest news, data, and analysis on special purpose acquisition companies, drawing on proprietary intelligence from Mergermarket and Dealreporter, as well as data from Dealogic.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds