Clean capital: record impact fundraising creates pools of do-good money

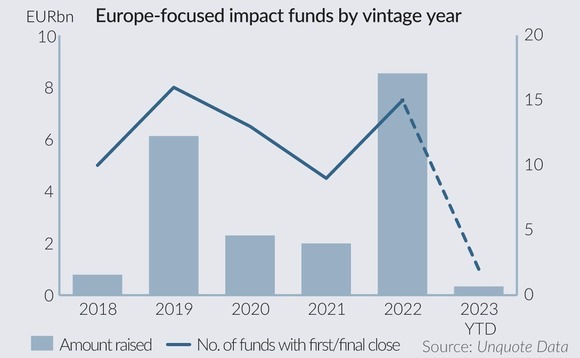

Over the last few years, investors have become much more upfront about how exactly their capital-allocation decisions benefit society in areas like healthcare and decarbonization. So big is that change that the amount raised by Europe-focused impact funds reached a record EUR 8.5bn in 2022, over 4x the amount raised a year prior, according to Unquote Data.

Although the direction of the secular trend is clear, 2023 is off to a slow start, reflecting wider woes in the fundraising market. Just two funds, Planet A and Panakès Partners, have raised a combined EUR 335m for their impact-angled vehicles - a sharp drop off from last year.

But the strategy is clearly on the rise with 39 impact funds registered or closed in 2022 - almost double on the year prior.

First-time funds an acute challenge to attract LPs due to the ongoing fundraising drought. Spex Capital is launching a EUR 100m health tech fund, with other impact vehicles in sight, while Ocean 14 Capital is nearing a close of EUR 150m on its ocean-focused vehicle.

Meanwhile, established managers are also linking carry agreements for specific vehicles to impact objectives, like EQT's Future Fund and Apax's Global Impact, which are both in fundraising mode.

Tracked impact

Most impact vehicles are classed as Article 9 funds under the EU's Sustainable Finance Disclosure Regulation (SFDR), meaning that the fund's objectives have to be a "sustainable investment" or involve a "reduction in carbon emissions".

LPs have been frustrated by this broad definition as it means many funds set their own internal benchmarks over what constitutes an impact investment. Investors into funds will also be keeping an eye on whether Article 9 funds get downgraded, losing a key stamp of quality.

However, one benefit of the broad scope is that it leaves big pools of capital for sector diversity: Healthcare, climate tech, agricultural tech, energy transition, cybersecurity, education, among others, could all benefit from impact money.

Finding suitable investments is likely to be less problematic than fundraising. Impact funds have a different emphasis from investors with environmental, social and governance (ESG) concerns, but executives seeking backing often use ESG as a shorthand.

Dutch battery tech firm LeydenJar, which is looking to raise above EUR 100m, according to proprietary intelligence from sister publication Mergermarket, could be an easy target for impact money. Other options include Swiss carbon reduction company Climeworks, which is seeking a private round ahead of IPO, and green storage energy solutions player HPS as part of a EUR 50m growth raise.

| Vintage year | Fund name | GP | Final close (EURm) |

| 2022 | KKR Health Care Strategic Growth Fund II | Kohlberg Kravis Roberts & Co (KKR) | 3,519 |

| 2019 | TPG Healthcare Partners | TPG | 2,473 |

| 2019 | KKR Global Impact Fund | Kohlberg Kravis Roberts & Co (KKR) | 1,176 |

| 2020 | Trill Impact Fund | Trill Impact | 900 |

| 2022 | Lightrock Climate Impact Fund | Lightrock | 860 |

Money morality

While a sponsor can control the impact while it owns a company, the nascent asset class is still considering what to do when it sells, particularly if the margin-wary highest bidder wants to emphasize financial metrics over societal impact.

British sponsor Palatine recently exited vocational trainer Skills4U, the sponsor's first-ever impact investment, saying that any change in the impact angle across its exited portfolio would fundamentally dilute the business.

Still, the few impact-adjacent exits seen thus far have performed well, which is especially important in this environment as commercially driven LPs will not want to compromise on returns. For example, ECI sold low-emission vehicle leasing company Tusker to Lloyds Banking Group for a 6.2x return, while Tikehau made a 3x return on its partial realisation of EuroGroup Laminations through IPO, having first invested under its T2 Energy Transition Fund.

There might be a dip in impact fundraising as LPs contend with the denominator effect, but public markets can be too short-term focused to properly deploy moral money. This means private assets with a longer-term view are best positioned to truly make an impact.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds