Lower mid-cap valuations near 2006 levels

Multiples paid by both private equity houses and trade buyers for lower mid-cap assets reached their highest level in nearly eight years in Q2, according to the latest Argos Mid-Market Index. Greg Gille reports

Even though easier access to financing and greater confidence combined to boost activity at the larger end of the market in the first half of the year, quality assets remain scarce at the lower end of the spectrum – resulting in a further increase in median valuations in the €15-150m space across Europe.

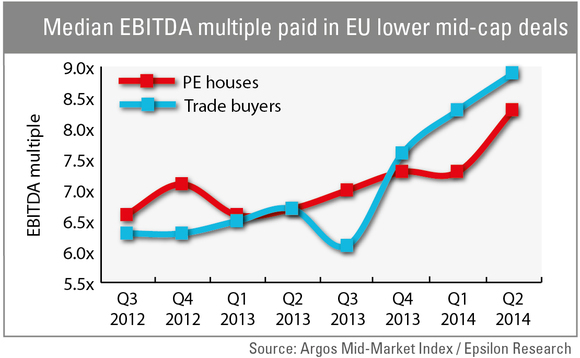

Transactions in that market segment were valued at a median 8.6x EBITDA in Q2 2014, according to the latest Argos Mid-Market Index, published by Argos Soditic and Epsilon Research. This marks the highest point reached by the index since the second half of 2006, when the median entry multiple stood at 9.1x EBITDA. The index has also been rising steadily in the past 12 months, with a 28% increase on the median 6.7x multiple recorded in Q2 2013.

As already witnessed since the tail-end of last year, strategic buyers were particularly bullish in the past quarter, paying a median 8.9x entry multiple for lower mid-market assets. This stands in stark contrast with the 6.1x multiple seen just three quarters ago, although some way off the record-high 10.5x mark reached in the second half of 2006.

While private equity players seemed to be exercising a greater degree of caution in the first months of 2014, they are now catching up fast: such buyers paid a median 8.3x EBITDA for lower mid-cap businesses in Q2, against 7.3x in the first quarter. The Q2 median actually exceeds those seen in the 2006-2007 boom years, falling just shy of the 8.7x recorded in the latter part of 2005.

Competition rife

As was the case in the previous quarter, a number of factors are contributing to this increase, chief among them the level of competition for the most attractive assets. This is compounded, as the report highlights, by the significant amounts of dry powder available to buyout houses at this end of the market, as well as plentiful financing options (thanks in no small part to the continued popularity of unitranche products).

But other factors, on the supply side this time, could play a role in shaping the evolution of entry multiples in the second half of the year. While trade players have been busy with acquisitions in the past few months (contributing to the aforementioned hike in valuations seen in corporate M&A deals), their contribution to European private equity dealflow in the form of carve-outs shows signs of ebbing.

After several months of steady increases, both the volume and value of transactions sourced from trade vendors decreased for the first time in Q2 this year, according to unquote" data. Should this trend continue in the second half of 2014, competition for the assets that do make it to the market could prove even fiercer – whether or not buyout houses can stomach the further hike in valuations remains to be seen.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds