Listed private equity recovery underway

Subjected to unstable public markets since the 2008 crisis, many quoted vehicles have seen their value fall. John Bakie investigates if this may change soon.

The recent past has been tough for private equity's listed funds. Subjected to the full force of public markets during the fallout of the financial crisis, many vehicles have seen progressively dwindling share prices and deepening discounts.

Stuart Howard, chief operating officer (COO) of European listed products at HarbourVest, and a 3i veteran, believes this may end soon, saying the tide is turning for listed private equity. While funds suffered in the wake of Lehman Brothers¹ collapse, the recovery is now beginning. "HVPE (HarbourVest Global Private Equity) listed in 2007, and while net asset value (NAV) has climbed some 35%, shares slipped from a starting price of $10 down to around $5. Now they are starting to recover and are trading nearer to $7," he explains.

Howard believes the key to reducing the discount gap and improving investor interest in listed private equity is better communication by the industry. "Private equity has been very private and not open enough, but we need to explain this distinct asset class to investors," he says.

Since joining HarbourVest in January, Howard has held some 80 meetings with investors, brokers, journalists and trade bodies to further the message about what listed private equity is and how it can benefit a portfolio.

Listed Private Equity's (LPEQ) Ross Butler agrees with Howard's strategy of educating investors: "We're dedicated to raising awareness of private equity in listed markets, and we have made a lot of progress in this area since LPEQ was founded in 2006." Confusion about what listed private equity is, and how it differs from other alternative assets, can be a key barrier to investment. "I have spent a lot of time explaining to investors that private equity is not overvalued, and it's not all about fees on top of fees," says Howard. Many investors naturally tend to compare private equity to hedge funds, but Howard says they often fail to realise that fee structures are largely the same and the private equity model makes returns in a very different way to a hedge fund. "Debunking myths is a key part of what we are doing," he adds.

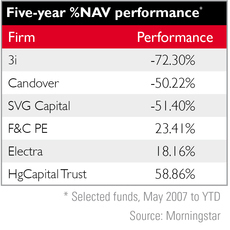

Investors may also be put off by the poor performance of a number of funds following the financial crisis. As the Five-year %NAV performance table (see below) shows, some of the biggest post-crisis names in listed private equity have seen NAV collapse since 2007. These high-profile cases will have spooked many investors and have led to discounts widening to 60% or more at the bottom of the market.

However, with discounts starting to close, many public market investors may be getting over their fear of the asset class. Jock Green-Armytage, part of JZ Capital Partners¹ (JZCP) European team, says: "The large discount is largely the result of an overreaction to some poorly performing, iconic funds. Investors are starting to realise that many of the funds that did badly were over-committed and under-resourced when the crisis hit, which is not the case for many other funds." Talk alone is not enough to convince investors; listed funds also need to demonstrate that they can return money to investors. Deep discounts to NAV seen after the collapse of Lehman Brothers could be beneficial to investors.

"The discount to NAV has widened dramatically. Having historically sat at a percentage discount in the mid-teens, today funds are trading at an average discount of more than 30%, and listed private equity has not seen a recovery in line with the rest of the stock market," says Butler. While this may have caused concern among investors, it also offers them the chance to obtain shares at a deep discount and benefit from significant uplift over the long-term.

However, for some public-market investors, the prospect of distant capital gains may be less tempting that obtaining significant yield. "There's a pretty big focus on yield in the investment world at the moment," Butler says.

Show me the dividend

Some listed funds are already exploring options to pay dividends on a more regular basis. F&C Private Equity recently announced it would seek to do so, equivalent to 4% of NAV. The news was met with a sudden rise in the fund¹s share price and reduction in its discount, though it is unclear whether this change was due to good performance figures or the revised dividend offer.

In May, JZCP followed in F&C's footsteps, announcing it would pay a dividend calculated at 3% of NAV per annum, representing a yield at discount of approximately 5% (based on 16 May share prices). This too was met with an increase in share price and closing of the discount gap.

Green-Armytage says: "[The dividend] does have an effect on investor sentiment. At our current share price, this is equivalent to a 5% yield, which is difficult to get at the moment." David Macfarlane, chairman of JZCP, adds: "For investors, being paid an income while you wait until you can realise your capital increase is an attractive prospect." However, despite investor appetite for yield at the moment, listed private equity is, and will remain, an asset class that is primarily focused on capital growth over income, and those investing should expect a long-term commitment.

"There are a number of funds now looking at dividend payments as a method of discount control," says Butler, "but those investing in listed private equity should be focused on the potential for capital gain." Green-Armytage agrees that capital growth is still the primary driver in private equity investment: "The dividend is a good way of smoothing out the discount but will not close the gap on its own."

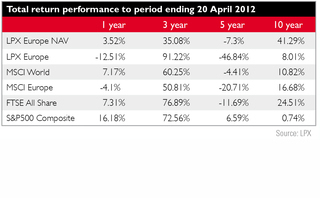

Figures from LPX (below) show how listed private equity funds have, over the long-term, significantly outperformed other benchmarks, and with many funds currently selling at a discount of around 30%, there are significant opportunities for uplift over and above the achievement of NAV. With a number of funds now seeing exits in their underlying portfolios, listed funds will be hopeful investors will start to come on board again as they see funds demonstrate the real value being created in their portfolios.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds