Mega-buyouts fail to recover in 2011

This week, KKR announced what is likely to be one of the last large-cap deals of the year with its $1.12bn secondary buyout of Capital Safety Group (CSG). But how has 2011 as a whole stacked up in the mega-buyout arena? John Bakie investigates

Many had hoped that 2011 would see the valiant return of the mega-buyout (valued at €1bn or more), after several years where constrained bank finances were hampering activity at the top end of the market. While this year has certainly seen some activity in the large and mega-cap segments, how does it stack up against recent trends?

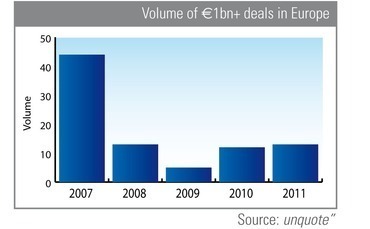

unquote" data reveals the picture is not quite as rosy as many market commentators had predicted earlier in the year. As the below graph shows, mega-buyout activity has barely increased since last year, with just 13 deals valued at over €1bn in 2011, compared to a whopping 44 in 2007 before the financial crisis hit.

Furthermore, the bulk of activity for 2011 was seen during the second quarter, with 8 mega-buyouts between April and June. While the market was relatively optimistic at that point, the mood has soured since then. With the euro crisis and threat of a Europe-wide recession now looming in people's minds, many are adopting a wait-and-see approach before engaging in significant M&A activity.

Bain Capital and Hellman & Friedman's secondary buyout of EQT's Securitas Direct was the largest deal of the year, weighing in at over €2.3bn (SEK 21bn). The eye-watering 14x EBITDA valuation may in large part be due to the huge growth the firm achieved under EQT's ownership, adding 20% to its profits year-on-year.

Another secondary buyout followed close behind courtesy of Clayton Dubilier & Rice (CDR), which led a consortium in buying French engineering group SPIE from EQT Partners for €2.1bn. The firm had attracted considerable attention, but CDR's offer was accepted by PAI before a formal auction process had even begun.

Meanwhile, Com Hem was the second Swedish company to make it into the top three. The estimated €1.85bn deal, also a secondary buyout, saw BC Partners buy the cable TV company from Carlyle and Providence Equity Partners. As with Securitas, the deal is thought to have fetched a hefty EBITDA multiple, highlighting the relative strength of the Swedish market.

While earlier talk of recovery in the large buyout space was perhaps premature, 2012 holds both challenges and opportunities. A number of major buyouts are already thought to be underway in Europe and, while the Eurozone crisis is ongoing, banks are expected to be able to start lending again with fresh balance sheets come the New Year.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds