BC Partners

PlusServer owner BC Partners seeks sale via Jefferies as loan maturity looms

GP acquired the German cloud solutions group in 2017 via BC European Capital X

Aenova sponsor BC Partners taps Jefferies to explore exit options

GP previously attempted to sell the pharma and healthcare CDMO in 2018, Mergermarket reported

BC-backed VetPartners sees initial bids fall short of price expectations

Ongoing buyer and seller valuation expectation gap has hit the sale of the vet clinic chain, sources said

Slice of pie: New entrants gobble up GP stakes in Europe

Armen, Hunter Point Capital, GP House and Axa IM rustle up new minority investments, as Inflexion and Coller sell

PE roll-up strategies face regulatory heat with focus on consumer industries

With longer holding periods facilitating more bolt-ons, regulators including the UK's CMA are intervening

BC Partners acquires Metropolitan College, AKMI IEK in second deal from Greece-focused fund

Sponsor will support the post-secondary education provider with organic growth, plus add-ons in the Balkan region

Eurazeo's Groupe Premium attracts multiple PE bidders ahead of IMs

Insurance broker has seen interest from parties including Ardian, Bridgepoint, BC Partners, Cinven, CVC

The Bolt-Ons Digest – 21 February 2023

Unquote’s selection of the latest add-ons with Investindustrial's CEME, Astorg's Fastmarkets, H&F's TeamSystem, and more

BC's VetPartners sees Blackstone, KKR, Partners Group among parties preparing bids

Veterinary group could fetch a valuation in the GBP 2.5bn-GBP 3bn region, having been acquired by BC in 2018

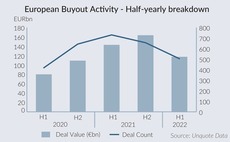

Constructive approach: PEs turn to bolt-ons amid exits and debt crunch

Buy-and-build strategies to take centre stage for sponsors faced with longer holding periods and tough market for platform investments

The Bolt-Ons Digest – 26 January 2023

Unquoteтs selection of the latest add-ons, with ICG's Circet, Five Arrows' Mintec, Carlyle's Jagex, and more

LP stakes trade on wider discounts amid liquidity crunch – Palico

More than half of LP deals were discounted in Q3 2022, reversing the trend seen in Q2, Palico report shows

The Bolt-Ons Digest – 11 November 2022

Unquote’s selection of the latest add-ons including Hg and ICG's Iris, Inflexion's THE, Bain's House of HR and more

BC Partners hits brakes on iQera sale amid market volatility

Sale of credit management provider not formally called off; could relaunch when conditions improve

The Bolt-Ons Digest – 16 September 2022

Unquoteтs selection of the latest add-ons with A&M's Ayesa, BC Partners' Valtech, Advent's IRCA, EQT's IVC Evidensia and more

BC Partners to join Bain as co-investor in Fedrigoni

Valued at around EUR 3bn, the Italian paper and label manufacturer will also receive co-investment from Canson Capital

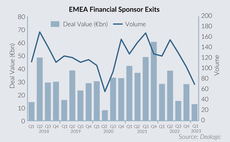

Deft deployment, creative exits drive PE agenda into H2 2022

Take-privates, bolt-on opportunities and demand for resilient healthcare and technology assets offer hope for challenging second half of the year

3i sells Havea to BC-led consortium

BC Partners is acquiring the French natural healthcare group with co-investors PSP and National Pensions Services Investment Management

Hg's MEDIFOX sale launch draws large-cap sponsor interest

Hg acquired the software platform for care providers in 2018 from ECM Equity Capital Management

BC Partners, Ardian among sponsors in second round of Simago sale

Antin and Eurazeo also in race for minority stake in the French medical imaging specialist

BC Partners, Cinven, Apax and Wendel circle Havea sale

French natural consumer healthcare manufacturer is set to collect non-binding bids next month

HIG Capital hires Madsen from BC Partners

Stephan Madsen joins HIG's European Middle Market team, where he will focus on the Nordics

Bridgepoint in exclusivity to acquire G Square's Dentego

Mergermarket reported that sponsors including Ardian, BC, Eurazeo and IK showed interest in the asset

GP Profile: BC Partners looks to steady deployment ahead of next fundraise

Head of IR Alexis Maskell details the GP's plans to lay strong foundations for when it next hits the road, possibly in H2 2023