Care providers attract increasing share of PE healthcare deals

While private equity dealflow in the healthcare sector has continued to decline in recent years, one bright spot is emerging within the space – healthcare providers. Vidur Sachdeva drills down into the data

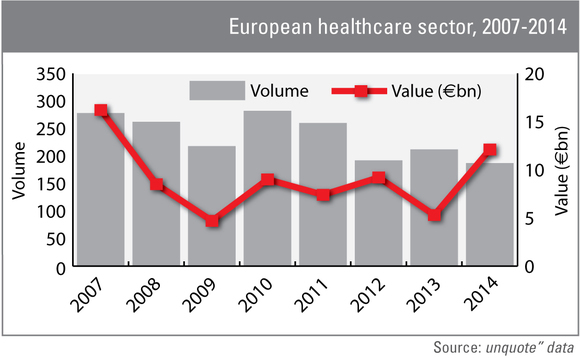

Private equity activity in the European healthcare sector between 2010-2013 has been characterised by declining deal volume and overall value. At the start of 2010, 282 deals were reported, worth a combined €9bn. By contrast, 2013 saw dealflow in the sector decline to 212 deals worth an aggregate €5.3bn.

According to unquote" data, last year witnessed a partial divergence from that trend as values surged even as volume continued to slide. Investment in the sector totalled €12.1bn across 187 transactions in 2014, marking an increase of 130% in terms of value and a decline of 13% in terms of volume. A closer look at the data reveals four mega-buyouts (€1bn+) during the year accounted for the steep rise in aggregate deal value. In contrast, the largest deal of the previous year – EQT's acquisition of Terveystalo Group in Finland – was estimated at €650m.

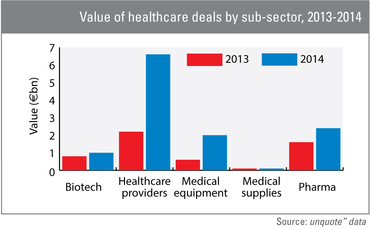

Although the impressive rise in deal value was registered across all five sub-segments (unquote" data classifies deals in the healthcare sector under: biotechnology; healthcare providers; medical equipment; medical supplies; and pharmaceuticals), one sub-sector was responsible for the almost two-thirds (64%) of this growth: healthcare providers. These deals generated 28% of the aggregate value in the healthcare sector in 2012, 42% in 2013, and 54% in 2014. In fact, the total value of private equity investments in the sub-segment nearly trebled from €2.2bn in 2013 to €6.5bn in 2014 – marking a seven-year high.

In volume terms, healthcare providers have proved a few bright spot within the industry. Of the five sub-categories within the healthcare sector, only two reported an increase in aggregate deal volume in 2014 – healthcare providers and medical supplies providers. The healthcare provider segment registered a 39% rise, from 29 deals in 2013 to 40 deals in 2014.

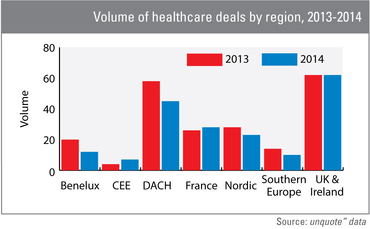

Looking at individual countries, healthcare providers have been particularly attractive to private equity investors in the UK and France. The UK led the pack in terms of deal volume, as it was home to 13 transactions valued collectively at €796m. France outpaced the UK in terms of deal value, with seven deals worth €2.4bn. Collectively, the two countries accounted for half (20 deals) of the total number of deals and half (€3.2bn) of the total value of transactions in the sub-segment.

After a dry spell in both 2012 and 2013, Sweden was home to five such transactions in 2014 – the highest annual volume the country has ever recorded within the sub-segment. Consequently, the Nordic region reached an eight-year peak, with eight deals that targeted healthcare providers completed in 2014.

In terms of deal types, buyouts not only accounted for half the deal volume in the sub-segment with 20 transactions last year, but more than four in 10 buyouts in the sector involved healthcare providers. Early-stage deals, meanwhile, staged a strong return with five deals (an all-time high) within the healthcare provider sub-sector in 2014, after failing to record a single transaction in 2013. Three of these deals took place in the UK/Ireland region and the remaining two took place in the Netherlands and Sweden.

Finally, the healthcare provider segment has attracted investments across all size ranges. Of the four €1bn+ buyouts in the healthcare sector in 2014, two involved healthcare providers: Advent International and Marcol Healthcare divested Berlin-based healthcare provider Median Kliniken to Waterland Private Equity for an estimated €1bn; and Bridgepoint acquired Médi-Partenaires, a private hospital group in France, from LBO France and Equistone for €1bn. Consequently, the average size of private equity deals involving European healthcare providers rose to an all-time high of €164m, 9% more than the previous peak of €151m in 2007.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds