LP caution hits life science investments

Universities can be a safe environment to raise funds and develop ideas. But it looks like university clusters are losing their pull factors in the eye of diminishing returns to investors. Anneken Tappe investigates

Leiden University's Bio Science Park is the largest science cluster of its kind in the Netherlands and home to more than 70 companies. It offers office and lab space, financial support and most importantly concentration of knowledge. When it comes to biotech and pharma investments, venture capitalists seem to have no fear to commit to companies that are part of a university cluster.

"It is related to the education of the researcher and the availability of capital," says Edward van Wezel, managing director of Forbion Capital's Biogeneration Fund. "If you are closely linked to a university, chances are you are on the forefront of science."

But it is not only skills and knowledge that make the proximity to an institution with a prestigious research centre valuable for start-ups. Instruments and facilities, particularly in the field of bioscience, are too expensive to invest in, explaining why entrepreneurs would want to settle close to a campus.

"VCs can provide spin-out support in form of independent outside expertise. Some projects, for example, are not broad enough to set up a separate company, but are more eligible for an out-license," van Wezel continues.

"I've seen many excellent opportunities killed by bad management. Academia can learn something from venture capitalists," Sander van Deventer, partner at Forbion Capital Partners, adds.

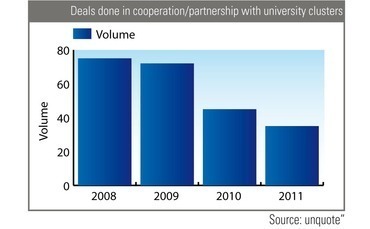

It seems like the perfect match: expertise and availability of capital meet in the most stimulating environment. Yet, unquote" data highlights that investments in university-related ventures have declined over the past few years.

Despite the undeniable advantage of skilled researchers, the life science sector has to face the challenge of not being very LP-friendly. The cost of failure for biotech enterprises can be very high, culminating in a loss after long phases of clinical trials and development.

"It's not the false negatives, but the false positives that are costing you the money," says Kevin Johnson, partner at Index Ventures.

While Johnson agrees that clusters can improve the probability of success, the necessity of delivering returns is pulling investors towards other approaches in life sciences investments.

"We are following an asset-centric model, which is more like a confederation of development experts through CROs, and the company is a vessel for the project at hand. It really is project finance," he continues. The new model takes traditional portfolio management out of the equation and allows a more efficient focus on research.

However, interest in investing in university clusters has not disappeared and neither has the necessity of venture capitalists bringing in invaluable business acumen to the most research-focused start-ups. Index' asset-centric model shows that even in a sector like life sciences, which enjoys great popularity in tough economic times, streamlining and innovation are necessary to remain competitive.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds