Buyouts spring back in 2010

Preliminary figures for the European Buyout Review 2011 confirm the general feeling in the market that buyout activity has bounced back in 2010. Emanuel Eftimiu gives an overview

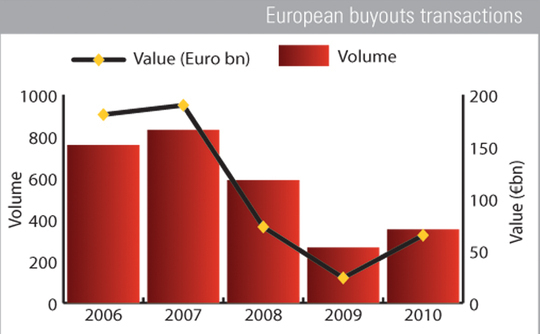

After what had been a statistically dreadful 2009 that saw European buyout activity reach a new low of just 266 transactions worth €23.8bn, 2010 could only get better. And while the first few months this year made a private equity recovery look like wishful thinking as transaction activity remained subdued, the second half of the year has not only seen the return of the mega buyout but also of healthy activity at the lower end of the buyout spectrum. The latest figures from unquote" research put this year's buyout tally at 353 deals worth almost €65bn. While that's an increase of around 33% in volume terms compared to 2009, total value of buyouts has almost tripled. While leverage has remained a difficult commodity to come by in 2010, a buoyant high-yield market has led to several transactions being closed at the top end of the market. Indeed, buyouts valued at more than €1bn accounted for almost 40% of the total transaction value.

As usual, the UK heads up the stats with more than a third of all buyouts completed, while transactions such as Tomkins, RBS WorldPay, Autobar and Brit Insurance have seen the country's share in total value increase to a staggering 44%. French buyout activity recorded a comeback with 61 deals recorded worth €8.6bn - an increase of 13% and 255% respectively and by far the highest volume and value figures seen on the continent.

Interestingly German activity did not record a similar bounce, with buyouts only slightly up to 38 deals in 2010, while total value slumped from an, for German standards, meagre €4.7bn in 2009 to a new low of just €3.4bn. It is worth remembering that the Kion Group buyout at the end of 2006 by KKR and Goldman Sachs Capital Partners was valued at €4bn alone.

This year was further characterised by secondary buyouts, or at least that is the impression one got from the abundant media coverage on "pass the parcel" deals. While the statistics do show a resurgence of deals sourced from fellow private equity houses, with almost 30% of buyouts falling into this category, it is worth remembering that secondary buyouts have consistently accounted for more than 25% of transaction volume over the past five years, with the exception of 2009.

For an in-depth analysis of the European buyout market, look out for the 22nd edition of the European Buyout Review to be published in February 2011.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds