Pricing expectations begin to level out

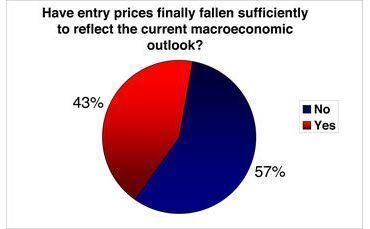

The latest unquoteт online poll reveals that the pricing mismatch that is said to have hampered dealflow throughout last year is still noticeable, although the gap has narrowed. Mareen Goebel reports

While as many as 85% or respondents to the same poll last year believed that sellers were still demanding unreasonable asking prices in the light of the macro-economic outlook, the latest result reveals that now only around six in ten see valuations as still being too high.

Although for a buyer an entry price can certainly never be low enough, the resilience seen in pricing indicates that vendors are still of the opinion that current prices are not a fair reflection of the true value of their assets and therefore are willing to hold on to their assets for as long as possible.

At the same time some GPs are starting to feel the pressure to invest having been either preoccupied with their portfolio companies over the past 18 months or decided to stay out of the market altogether. Add to this the strategic investors that have come back to the market looking for acquisitions, and it is easy to see why valuations have remained unexpectedly high, regardless of the macroeconomic outlook. "Judging by the sales processes we've been taking part in, the multiples are coming closer together, but mostly because the extreme offers are gone. The average though still continues to be fairly high," comments Nikolai Mackscheidt of German-based small-caps investor BPE.

What is more, recent deals have shown that debt markets are certainly thawing, which should result in more GPs coming back to the market and therefore increasing competition for assets as the year goes on. Current valuations might prove to be the bottom after all.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds