Does private equity need to hedge?

James Stretton of JC Rathbone Associates explores the arguments for and against foreign exchange hedging, given continued volatility in the currency markets since last summer.

Now more than ever, foreign exchange (FX) hedging is a critical consideration for private equity houses and their portfolio companies. The counterpoint to this hypothesis is that over the long term, in a diversified portfolio, FX losses and gains balance out. Given the finite nature of private equity funds and limited diversity of typical portfolios, however, this is not a valid argument.

Since last summer, there has been a dramatic rise in implied FX volatility.

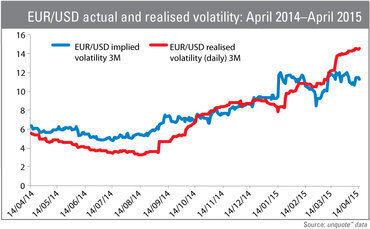

The EUR/USD three-month volatility, for example, has risen from 5% to more than 12%. Interestingly, this rise in implied volatility (the market's best guess as to actual future volatility) predicted what actually happened. Realised volatility (that is, the measure of what happened) also rose.

On the night of 18 March, US Federal Reserve chair Janet Yellen removed the word 'patient' from the Fed's press statement but then stressed this did not mean the Federal Open Market Committee (FOMC) was impatient to raise rates. This confused the FX market and EUR/USD rose 4 cents that evening, only to give back those gains during the course of the next day.

Many reasons have been put forward for these increasingly violent moves. The Fed and European Central Bank (ECB) are sitting at opposite ends of monetary policy, with the Fed apparently about to raise rates while the ECB has just embarked on quantitative easing. With interest rates everywhere so low, small differentials are making a big difference to FX rates. There is also anecdotal evidence that the Chinese and Russian central banks are diversifying reserves out of USD and into EUR to a much lesser extent than a few years ago. Hence a large volatility-dampening effect is absent.

International exposure

Whatever the reason for such swings in FX rates, they present a challenge for private equity. Few portfolios are so global and diversified that FX risk can be effectively ignored. This is even more true of investee companies, where even the most international businesses will always be exposed to an appreciation of their reporting currency. Corporates, including private equity investee companies, routinely hedge the transactional FX risk associated with importing and exporting.

Until recently, particularly for buyout funds with their traditionally high IRRs, FX hedging was rarely critical. Infrastructure funds, on the other hand, with their lower, more predictable returns, have more often chosen to hedge FX risk.

Of late, however, FX markets have become so volatile that even buyout funds should consider hedging. The challenge is all hedging involves a cost. This may be expressed either in cash (in the case of buying options) or in terms of credit (if some sort of fixed protection, such as forward contracts, is being considered).

GPs typically focus on FX exposures at entry and exit, using FX options or deal-contingent forwards. In between, however, the high cost of longer-tenor options and the high credit consumption of longer-dated forwards means hedging is often prohibitively expensive. To some extent, however, this can be got around by deferring (i.e. borrowing) the option premium until the expiry of the option. Banks may extend credit for this on the back of uncalled commitments.

Safe exit

There is a further strand to the importance of managing FX risk – exit valuation. While hedging transaction risk manages the portfolio company's liquidity and hedging at entry or exit protects value in the fund's base currency, neither protects the enterprise value of the business. A sterling fund with a portfolio company reporting in GBP can still have material exposure to FX if the net business revenues are significantly skewed to a currency other than GBP. The valuation multiple could mean the impact of a natural hedge, such as debt, is negated.

For those who still need convincing, there is an additional market-related factor. Since the financial crisis, implied volatility – i.e. what the market expects – in the EUR/USD market (the benchmark, as it is the most liquid market) has almost always exceeded realised volatility – what has actually happened. In other words, options have been relatively expensive when judged against actual market movement.

Since last summer, the opposite has been the case (see chart, above). Only once since the financial crisis, in 2010, has implied volatility been as far below realised volatility as it is now. It is as if traders cannot bring themselves to believe the markets will continue to be as volatile as they have been of late. Yet volatility itself, as the chart shows, whether measured on an implied or realised basis, is not particularly high on a historical basis. It is true there have been some decent moves in FX markets of late. But the big ones may be yet to come.

Businesses, like people, are inherently risk averse. They dislike a given loss more than they relish the equivalent gain. Fortunately, the market tends not to take this into account when pricing options, since one person's loss is another's gain. It is therefore possible to buy protective options that you value more highly than the market, and fund the purchase with the sale of options that you value less highly than the market. If managed properly, the result can be a zero-premium hedging strategy that nonetheless adds positive value for the hedger.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds