Consumer dealflow rebounds strongly in Q3

The consumer sector saw healthy amounts of inbound private equity interest in the third quarter of 2021, while more on-trend verticals such as technology and healthcare took a backseat, Unquote Data shows.

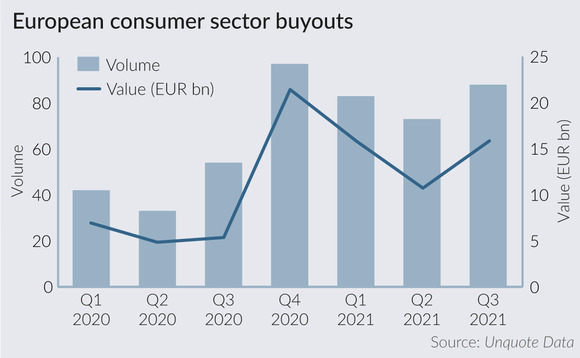

Europe saw a total of 88 private-equity-backed buyouts in the consumer sector in Q3, a 20% uptick on the 73 deals recorded by Unquote in the previous quarter. Aggregate value shot up by a more sizeable 50%, to reach an estimated EUR 15.8bn.

This made Q3 the busiest quarter for the sector since Q4 last year, when consumer deals totalled 97 buyouts valued at an aggregate EUR 21.4bn. While not setting a new record, Q3's tally is noticeably higher than that seen in an average pre-pandemic quarter.

Highlights that contributed to this strong performance include Investindustrial's deal for Zegna, bought via a special-purpose acquisition company that valued the Italian fashion brand at USD 3.2bn. Elsewhere, Cinven acquired a majority stake in Restaurant Brands Iberia – the master franchisee for the Burger King brand in Iberia – in a deal valued at more than EUR 1bn. Meanwhile, CVC acquired Medivet – a UK-based veterinary pet care business in which Inflexion owns a minority stake – in a deal that valued the company at around GBP 1bn.

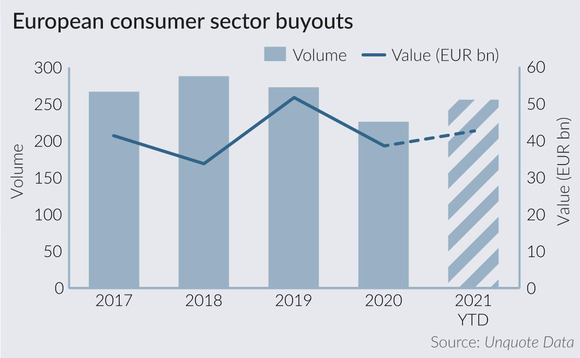

The increase in consumer dealflow over the traditionally quieter third quarter means that the sector is on track for a strong year of private equity investment. At 256 buyouts worth a combined EUR 42.6bn, 2021 has already seen more activity in this segment than in the whole of 2020 (226 deals worth EUR 38.5bn), and the tally should comfortably match pre-pandemic totals, assuming that activity holds strong in Q4.

Meanwhile, more on-trend verticals such as technology and healthcare took a backseat in the third quarter, Unquote Data shows. Technology saw dealflow levelling out quarter-on-quarter at 70 deals, but aggregate value was nearly halved down to EUR 6.9bn. Healthcare was down by around 8% across the board, while the financial sector saw buyout activity dip by 28% in volume terms and 60% by aggregate value.

Overall, European buyout activity was up by 3% volume-wise and 4% in value terms in Q3, making the consumer sector uptick stand out. But it was not the only "traditional" vertical to see frothy levels of activity as Europe emerges from the pandemic: dealflow in the industrial sector was up by 15% in both volume and total value.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds