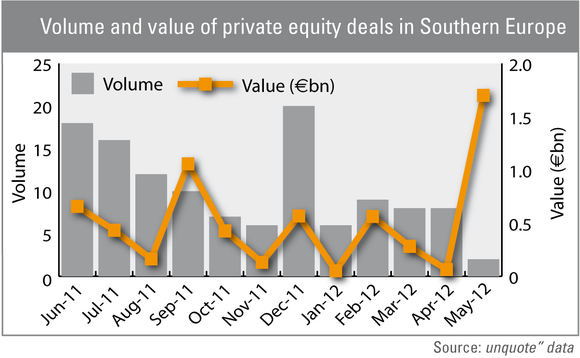

Southern Europe: Volume drops, value soars

Deal activity remained particularly subdued across Southern Europe in May, although the Rottapharm buyout in Italy sent overall value soaring.

It is too early to tell whether or not the measures enacted to support private equity in Italy, and the path of reforms Spain embarked on, will have a substantial impact on activity in the region.

Deal volumes registered a sharp drop in May, but the overall value invested shot upwards courtesy of Avista and Clessidra: the pair bought a 50% stake in Italian drugmaker Rottapharm, a deal that reportedly values the business at €1.7bn.

Doughty Hanson also did its part in Spain, buying a 40% stake in Quiron Hospitales with the intention of merging the business with its portfolio company USP Hospitales.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds