Dealflow: Tech more resilient than pharma

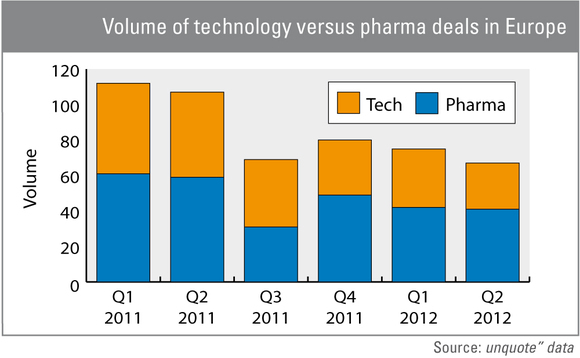

While overall activity declined gradually between Q1 2011 and Q2 2012 as macroeconomic conditions worsened, dealflow in the technology sector proved to be much more resilient than pharmaceuticals. This holds for both overall European and country-specific activity figures.

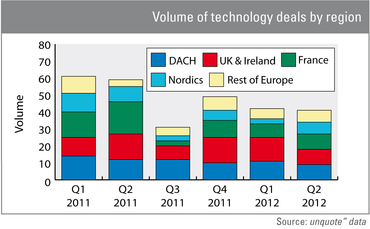

Tech investments saw a slump in Q3 2011, when the overall number of deals almost halved from 59 to 31 transactions in total. But they bounced back in the following quarter and seem to have stabilised at around 40 deals per quarter in 2012.

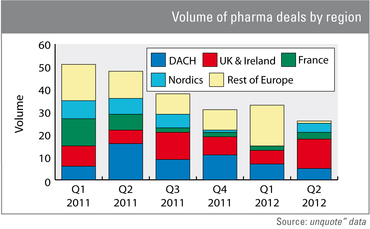

Pharma deals on the other hand show a very volatile investment activity in the different European regions. In Q1 2011, France registered 12 deals in the sector, accounting for the second largest number of deals that quarter, but it registered only two in Q1 2012.

UK investments in pharmaceuticals and biotechnology, however, seem to follow a similar pattern to tech deals: they decreased in Q4 2011 and Q1 2012, but shot back up to a new high totalling 13 deals in Q2 2012. Time will tell if this is a dead cat bounce or if investor appetite for pharma deals in the UK is firmly on the up.

Volatility in sectors that were made out to be safe havens speaks volumes of the cautiousness currently displayed by European investors. However, it could also indicate a shift towards a more opportunistic and deal-by-deal investment policy across the crisis-ridden European continent, resulting in unusual statistical patterns.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds